Oracles play a fundamental role in the blockchain ecosystem, providing highly valuable external data to smart contracts. However, current solutions have serious limitations in terms of scalability, update speed, and compatibility with multiple networks. RedStone was created as a modular alternative that optimizes data delivery to both EVM and non-EVM blockchains, overcoming these limitations through a flexible and high-performance architecture.

With a design that decouples data acquisition from its on-chain verification, RedStone enables fast updates, reduced costs, and greater adaptability for DeFi protocols, derivatives, and other applications that rely on real-time information. Its integration with more than 70 blockchains and the support of decentralized validators serve as proof of its security and reliability.

What is RedStone?

RedStone is a modular oracle designed to efficiently and scalably supply data to blockchains. Unlike traditional solutions, RedStone does not store all data directly on-chain but instead employs an intermediate distribution layer that optimizes data transmission without congesting the network.

Currently, it has positioned itself as one of the most widely adopted solutions, with more than 130 clients in the blockchain ecosystem and support for over 1,250 assets, including LSTs, LRTs, BTC staking, and others. Its modular architecture allows it to operate on both EVM-compatible blockchains and alternative networks, facilitating integration with a wide range of decentralized protocols.

How Does RedStone Work?

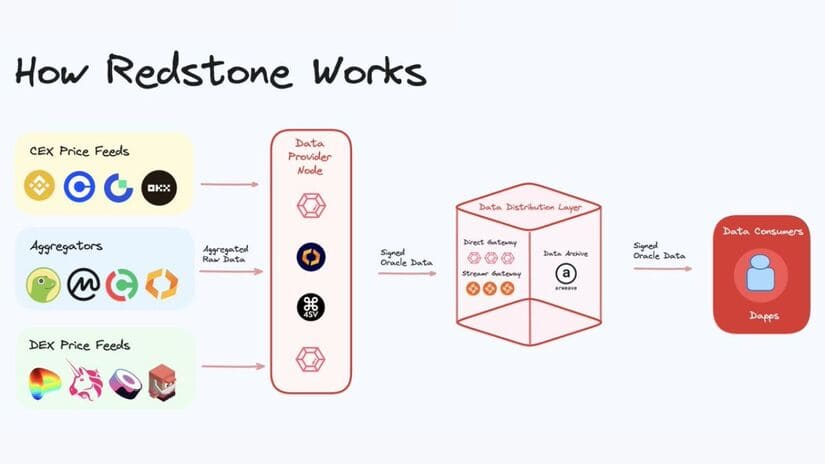

RedStone operates based on a decentralized model that optimizes data acquisition, validation, and delivery. It all starts with collecting information from multiple sources, including centralized exchanges, DEXs, specialized APIs, and other verified platforms. The data aggregation process filters out incorrect information and enhances the accuracy of values delivered to applications that rely on this data.

Once the information has been collected and processed, RedStone uses its distribution layer to transmit it to the blockchain. Instead of recording each update directly on the main network, it utilizes an intermediary infrastructure where the data is packaged and signed before being sent to the smart contracts that require it. This model helps reduce network congestion and optimize operational costs.

To ensure data security and integrity, RedStone implements a decentralized validation mechanism based on EigenLayer. Within this system, data providers must stake RED tokens as a guarantee of honesty. If they provide incorrect or manipulated information, their stake may be reduced or confiscated. This mechanism promotes system reliability and reduces the risk of price manipulation or critical data distortion in DeFi applications.

Technical Specifications and Architecture

As previously mentioned, RedStone’s architecture is based on a modular design that separates data acquisition from its delivery to the blockchain. This model enhances performance and facilitates integration with multiple networks without compromising scalability or security.

Multi-Chain Compatibility

Multi-chain compatibility is another strong point of RedStone. Unlike many traditional oracles that operate exclusively within EVM environments, RedStone is designed to function on both Ethereum-compatible blockchains and non-EVM networks. Currently, it supports blockchains such as Ethereum, Binance Smart Chain, Berachain, TON, and Monad. This expands its adoption potential within the Web3 ecosystem. Thanks to this flexibility, any protocol can integrate with the oracle without relying on centralized or single-chain-specific solutions.

What are Custom Oracles?

One of RedStone’s key differentiators is its ability to offer custom oracles. Instead of providing only a predefined set of data feeds, it allows developers to configure specific parameters according to their needs. This customization is particularly useful in sectors such as decentralized finance, where protocols require real-time prices for specific assets, and in the NFT and metaverse markets, where dynamic asset valuation is crucial. It is also applicable in on-chain audits, enabling the validation of DeFi platforms’ solvency through automated proof-of-reserve mechanisms.

Is RedStone a Secure Platform?

From a security perspective, RedStone has undergone rigorous audits by specialized firms such as Halborn, PeckShield, and Cantina. Additionally, its integration with EigenLayer strengthens system protection by requiring data providers to lock RED tokens as collateral. This structure reduces incentives for data manipulation and improves oracle decentralization, minimizing the risk of attacks or failures due to reliance on a single point of information.

What is the RED Token, and What Is It Used For?

The RED token is RedStone’s native asset and serves multiple functions within the ecosystem. Its primary purpose is to secure the protocol through a staking system applied to data providers. Any operator wishing to participate in data validation must lock RED tokens as collateral, ensuring their commitment to system integrity. If they supply incorrect or fraudulent data, their stake may be slashed or confiscated.

Beyond its role as collateral in the validation mechanism, RED also acts as an incentive for ecosystem participants. Operators who secure the network and provide reliable data receive compensation in assets such as ETH and USDC, encouraging active participation within the network. In terms of governance, the RED token allows holders to take part in decisions related to protocol development, such as infrastructure improvements and expansion to new blockchains.

Is RedStone a Good Investment?

From a technological standpoint, RedStone positions itself as one of the most advanced solutions in the blockchain oracle sector. Its modular architecture, customizable data feeds, and compatibility with multiple networks provide it with a competitive advantage over traditional solutions.

One of RedStone’s strengths is its significant adoption within the Web3 ecosystem. With more than 130 clients, the oracle has proven to be a reliable tool for DeFi applications and other sectors requiring real-time data. Additionally, backing from reputable investment firms indicates institutional interest in its long-term development.

However, the blockchain oracle sector is highly competitive and constantly faces challenges in terms of innovation and regulation. Established protocols like Chainlink dominate the market, which could pose a barrier to RedStone’s expansion. Moreover, the overall evolution of the crypto market will influence the demand for oracle solutions, potentially impacting the performance of the RED token in the future.

In general, RedStone presents a solid and continuously expanding technological proposition, which could support its long-term growth. However, any investment in digital assets carries risks, making it essential to evaluate the project based on its technological advancements, ecosystem adoption, and market conditions at any given time.

Conclusion

Undoubtedly, RedStone has made a technological leap in the oracle sector, offering a modular, scalable, and high-performance solution. Its approach to data optimization through an intermediate distribution layer allows it to provide reliable information without overloading blockchains, effectively addressing latency and high-cost issues present in traditional models.

Time will tell whether this solution can adapt to both market needs and regulatory changes. Beyond that, it is a platform with enormous potential to revolutionize the Web3 ecosystem and the blockchain industry as a whole