TL;DR

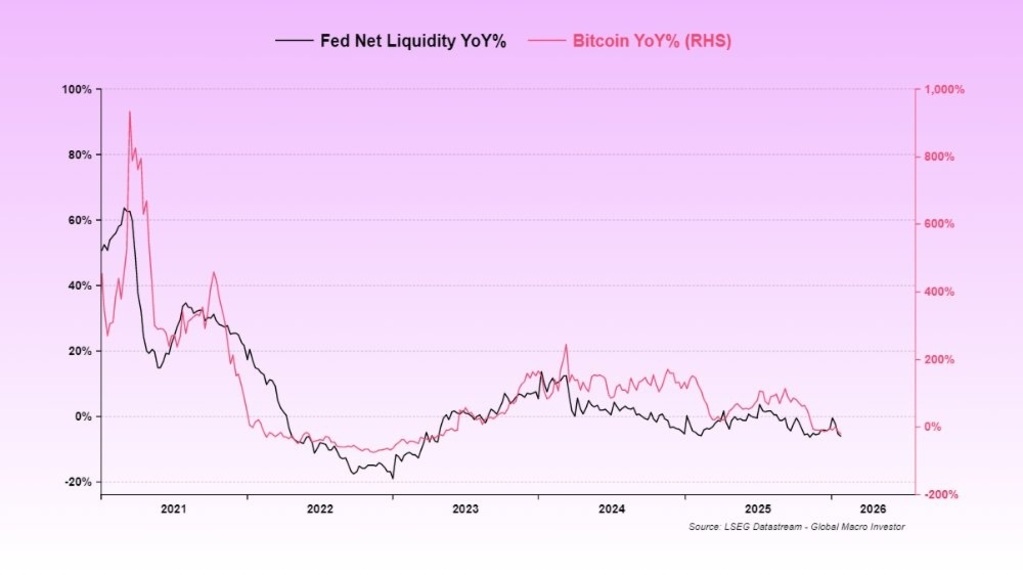

- Raoul Pal argues that Bitcoin’s decline mirrors SaaS stocks, caused by a temporary US liquidity contraction, not broken fundamentals.

- He identifies factors like the Reverse Repo drain and TGA rebuild as drivers of net liquidity extraction from the system.

- The gold rally absorbed all marginal liquidity, leaving longer-duration, riskier assets like Bitcoin starved.

Raoul Pal, co-founder of Real Vision, published an extensive analysis challenging the dominant narrative that Bitcoin and the crypto market are broken. The macro investor discovered that BTC and SaaS stocks share virtually identical charts, revealing an underlying factor markets have ignored: the temporary contraction of U.S. liquidity.

Pal explained a hedge fund client asked him about buying discounted SaaS stocks, given fears that tools like Claude Code have killed the sector. Upon investigation, he found SaaS and Bitcoin present the same decline pattern. The conclusion demolishes both pessimistic narratives and points toward a liquidity problem, not fundamentals.

The analyst noted that U.S. liquidity has been restricted due to two government shutdowns and problems with the financial system’s “plumbing”. The Reverse Repo drain was essentially completed in 2024, eliminating the usual monetary offset. The Treasury General Account (TGA) rebuild in July and August resulted in a net liquidity extraction from the system.

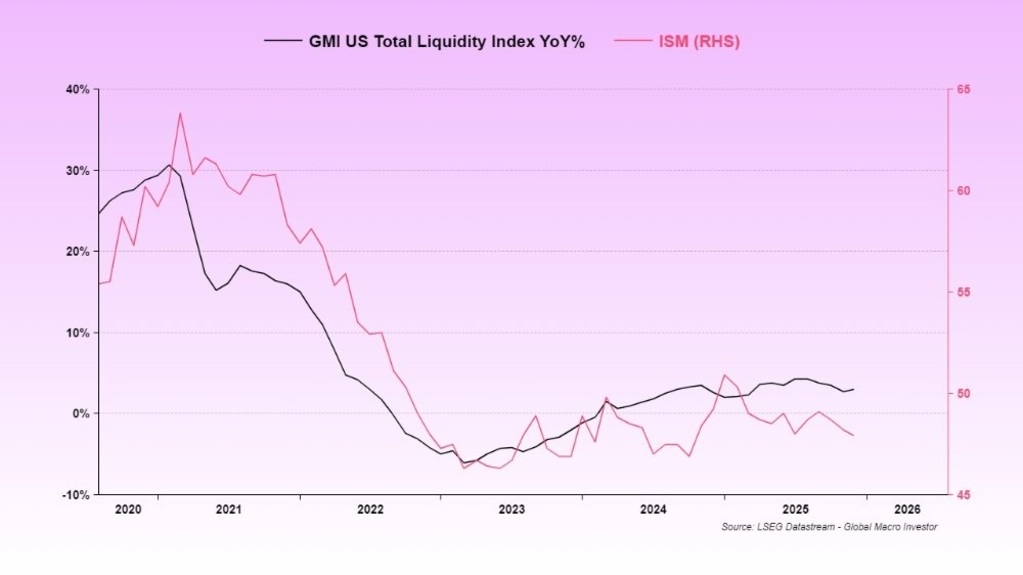

U.S. Total Liquidity (USTLI) has shown greater dominance in the current phase, contrary to previous cycles where Global Total Liquidity (GTLI) led. The weak ISM index performance reflects the scarcity of available liquidity.

Gold Rally Absorbed Marginal Liquidity

Pal argued the gold rally sucked all marginal liquidity that would have flowed into Bitcoin and SaaS. Both represent longer-duration assets and suffered discounts because liquidity temporarily withdrew. The system lacked sufficient liquidity to support all assets simultaneously, hitting the riskiest ones.

The U.S. government faces another shutdown. The Treasury hedged the risk without draining the TGA after the previous shutdown, adding more funds and creating another liquidity extraction. Pal identified the current void as the cause of brutal price action in crypto.

However, he projects the shutdown will resolve within days, removing the final liquidity hurdle. Pal repeatedly mentioned shutdown risk in previous analyses. Once overcome, he anticipates a liquidity flood from the eSLR, partial TGA drain, fiscal stimulus, and rate cuts oriented toward midterm elections.

Regarding Kevin Warsh as the new Fed chairman, Pal rejected the narrative he is hawkish. He stated Warsh’s mandate consists of applying the Greenspan-era playbook: cut rates, let the economy run hot, and assume AI productivity increases will contain core inflation, similar to the 1995-2000 period.

Pal acknowledged GMI’s error in not identifying U.S. liquidity as the current driving factor. He maintains a massive bullish stance for 2026 based on the Trump/Bessent/Warsh plan. He emphasized patience: time matters more than price in full-cycle investing.