TL;DR

- PayPal USD (PYUSD) has reached sixth place among stablecoins, with $2.761 billion in circulation in a $308 billion market.

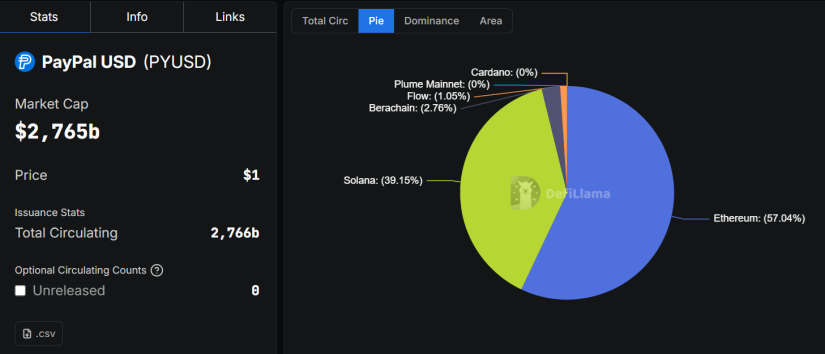

- Issued by Paxos and backed by U.S. dollars, the token grew by $1.761 billion in 77 days and is distributed across Ethereum (56.8%) and Solana (39.3%).

- The top 100 wallets hold 99.6% of the total supply.

The stablecoin market has surpassed $308 billion and remains concentrated among a few issuers, but the rise of PayPal USD (PYUSD) is beginning to shift that hierarchy.

The token, issued by Paxos Trust Company and backed by U.S. dollars, climbed to sixth place among the largest stablecoins, reaching $2.761 billion in circulation. Its market cap increased by $1.761 billion in just 77 days, making it one of the fastest expansions of the year.

PayPal Brings PYUSD Back to the Surface

PayPal launched PYUSD in August 2023 to connect traditional payments with digital assets under its brand. The token reached 1 billion units issued in its first year but lost momentum toward the end of 2024. Its recovery began in the third quarter of 2025, driven by deeper integration with PayPal and Venmo payment services and rising institutional use.

According to Defillama data, Ethereum holds 56.83% of PYUSD’s supply, while Solana accounts for 39.35%. The rest is distributed across smaller networks such as Berachain, Flow, and Plume Mainnet. This diversification contrasts with Ethereum’s absolute dominance in other stablecoins. PayPal aims to leverage multiple networks to reduce costs and speed up settlements.

A Highly Concentrated Market

PYUSD has surpassed BlackRock’s BUIDL ($2.687 billion) and World Liberty Financial’s USD1 ($2.674 billion). At the top remain Sky’s stablecoins (formerly MakerDAO): DAI with $5.146 billion and USDS with $5.319 billion. PayPal’s stablecoin performance shows how an institutional issuer can scale in a market historically led by crypto-native projects.

Etherscan data shows that most of the supply is highly concentrated: the top 100 wallets control 99.6% of all PYUSD. Among them are Copper, Paxos, Aave, Crypto.com, and Defiance Capital, collectively managing about 1.168 billion PYUSD, or 42% of the total. This concentration raises questions about liquidity and decentralization, though it highlights the token’s institutional profile.

PYUSD’s growth confirms that stablecoins backed by major financial firms are gaining ground in the sector. PayPal has successfully repositioned its digital dollar as a relevant asset in the market.