Pyth Network is a platform dedicated to providing data to the blockchain through oracles. Do you want to know what this technology is and why it is essential for the functioning of the blockchain? In this article we will take a detailed look at what Pyth Network is and how it works and tell you everything you need to know about oracles and their role in the crypto ecosystem.

What Is Pyth Network?

In a nutshell, we could say that Pyth Network is a blockchain-based oracle solution that is responsible for providing real-world data to smart contracts. Blockchains are designed to be closed systems, which means that they cannot access external information to maintain the purity and accuracy of internal data. While this ensures a reliable and secure system, it is impractical for wider adoption because it ignores the increasing connectivity of the outside world.

To solve this problem, what are known as oracles were developed. These third-party systems create an infrastructure that enables the accurate transfer of data to and from smart contracts. Pyth Network is one such oracle, launched in 2021, initially designed for the Solana blockchain and then expanded to a multi-chain solution to provide external data to the decentralized finance (DeFi) space.

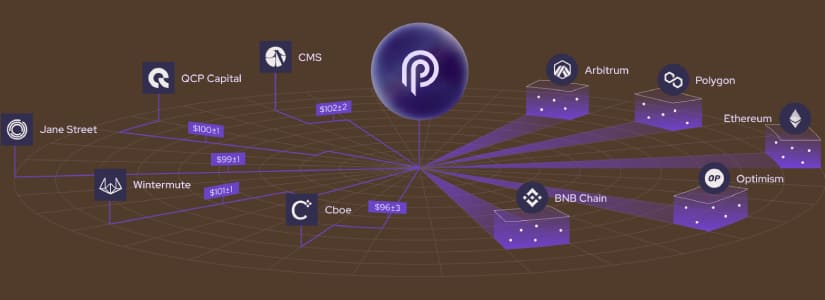

Unlike other oracles such as Chainlink, which get their pricing data from node operators, Pyth gets its information from financial institutions. These institutions share their unique pricing data on the chain, which is updated every 400 milliseconds. This data is collected and distributed to various smart contract applications to provide Pyth users with high-quality, time-sensitive data.

In addition, Pyth Network uses a governance token called PYTH, which allows holders to vote on changes to the development of the network. Although Pyth launched in August 2021, it has already gathered a large following and is used by hundreds of applications both on and off the blockchain, highlighting the genuine need for accurate, high-quality data in the DeFi space.

What Are Blockchain Oracles?

Blockchain oracles are services that allow smart contracts on a blockchain to access information external to the network. They act as bridges between blockchains, which normally cannot interact with data outside their network, and the real world. For example, a smart contract may need the current price of a cryptocurrency to execute a trade; the oracle provides this information.

There are different types of oracles, which can provide data such as asset prices, and even less conventional ones such as those that provide information on weather conditions measured by sensors, or sporting event results. Oracles are essential because they extend the functionality of smart contracts, allowing them to make decisions based on real-world information and not just internal blockchain data.

How Pyth Network Works

Pyth Network is an innovative and indispensable solution for the proper functioning of many DeFi applications. It works through a decentralized and open source infrastructure, which guarantees the integrity, transparency and reliability of the data it provides.

The process starts with the data publishers, which are financial institutions, trading firms and stock exchanges that supply price information to the system. This information includes asset prices for both cryptocurrency and non-cryptocurrency assets, such as stocks. The data provided by these primary sources is highly accurate and updated frequently, allowing Pyth Network to provide correct data to its users in real time.

The consumers in the system are the smart contracts and the users of these contracts that use the price data provided by Pyth. These consumers pay a fixed fee for each data request they make. By using these primary data sources, Pyth can ensure the speed and accuracy of the information it provides.

The system operates on a blockchain known as Pythnet, which is a hardfork of the Solana blockchain. In this network, each data publisher acts as a validator in a Proof of Authority (PoA) system. Pythnet collects prices from all publishers and generates a unique reference price for each listed asset. These prices are transmitted across different blockchains using existing inter-chain messaging protocols, allowing Pyth data to reach users on multiple networks.

An important feature of Pyth is that data is transferred only when users request (“pull”) it, which is more efficient in terms of gas usage compared to other oracles that send (“push”) data continuously, regardless of whether there is demand or not.

What Is Pythnet And What Is Its Function?

Pythnet is an application-specific blockchain managed by Pyth data providers. Pythnet was designed to securely collect and combine the prices reported by these providers, thus generating a single average price for each financial product they monitor.

Unlike other general blockchains, Pythnet is focused exclusively on price aggregation. It runs on Solana technology, but is a separate, Pyth-specific blockchain. This separation ensures that Pythnet can operate autonomously, while maintaining the security and reliability required for its functions.

The main objective of Pythnet is to ensure that the combination of prices from different suppliers is performed correctly and that the resulting information is always available and accurate. To achieve this, Pythnet allows anyone to verify that calculations are performed properly by reviewing the network transaction log. In addition, it has built-in mechanisms to ensure constant availability, even in times of high market volatility.

PYTH Token: What Is It And How Is It Useful?

The PYTH token is the governance token of the Pyth Network, which means that it allows its holders to participate in decisions on how the network is managed and evolves. To be part of the governance of the Pyth Network, users must “stake” or lock their PYTH tokens through a special staking program. This entitles them to vote on various community proposals, where each staked token equals one vote, following a 1:1 voting system.

In addition, anyone holding PYTH tokens can submit proposals for the network, as long as they hold at least 0.25% of the total PYTH tokens staked. These proposals are put to a vote for a period of seven days and are approved if they receive more votes in favor than against and reach a minimum percentage of approval, known as “approval quorum”.

Proposals can cover a variety of topics, such as the size of upgrade fees, the reward distribution mechanism for data publishers, the approval of software upgrades for programs on different blockchains, as well as the choice of publishers who are allowed to provide data for each price feed, among others.

Conclusion

As we have seen throughout this article, oracles play a key role within the blockchain ecosystem. As smart contracts become more popular and start to be more and more frequent in different applications, networks such as Pyth Network gain relevance.

If the current trend continues, it would not be surprising to see Pyth Network as one of the most important crypto projects on the market in the near future. Its development potential is enormous and its usefulness is even greater.