TL;DR

- Pump.fun acquired the multichain trading terminal Padre to strengthen token liquidity and expand the operational capacity of its ecosystem.

- The memecoin market has lost over 21% of its value in the past 30 days.

- The PUMP token rose more than 13% after the announcement, reaching $0.004, driven by purchases from two major investors and by buybacks covering 9.38% of total supply.

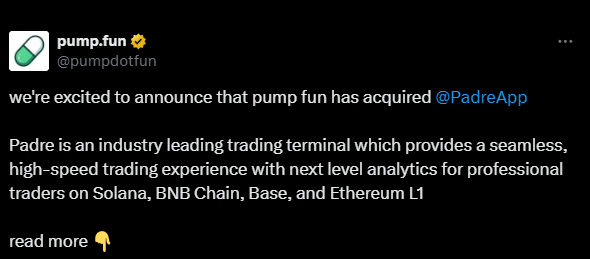

Pump.fun, the Solana-based memecoin launchpad, has acquired the multichain trading terminal Padre in a deal whose value was not disclosed.

The goal is to reinforce liquidity for listed tokens and improve trading infrastructure at a time when the memecoin market is under pressure, having lost more than 21% of its capitalization in the last 30 days.

According to the company, integrating Padre will expand the ecosystem’s operational capacity and optimize trading flows across networks like Ethereum, Solana, BNB Chain, and Base. Padre offers cashback on fees, dedicated support, and an interface tailored for active traders. Despite the overall market slowdown, Pump.fun aims to maintain and strengthen its leadership, holding about 44% of Solana’s memecoin launch market — down from a peak of 75% in 2024.

Pump.fun Revenue Dropped 80%

Pump.fun’s founder, Alon Cohen, said the acquisition followed several months of collaboration with the Padre team, which he described as one of the strongest in the sector for its execution and organic traction. The addition of the terminal is part of a strategy to sustain ecosystem growth and offset the sharp revenue decline seen in 2025. In July, the platform’s monthly revenue fell below $25 million — an almost 80% drop from the January peak, according to DefiLlama data.

The native PUMP token reacted positively to the news, rising more than 13% over the week to reach $0.004, recovering its level prior to the October 10 crash. Two large investors played a key role: one withdrew $2 million in USDC from Kraken to purchase 517.97 million tokens, while another opened a $3 million long position on Hyperliquid.

PUMP maintains an open interest of $354 million, with $143 million concentrated on Hyperliquid. The company allocates all its revenues to token buybacks, which now cover 9.38% of the total supply