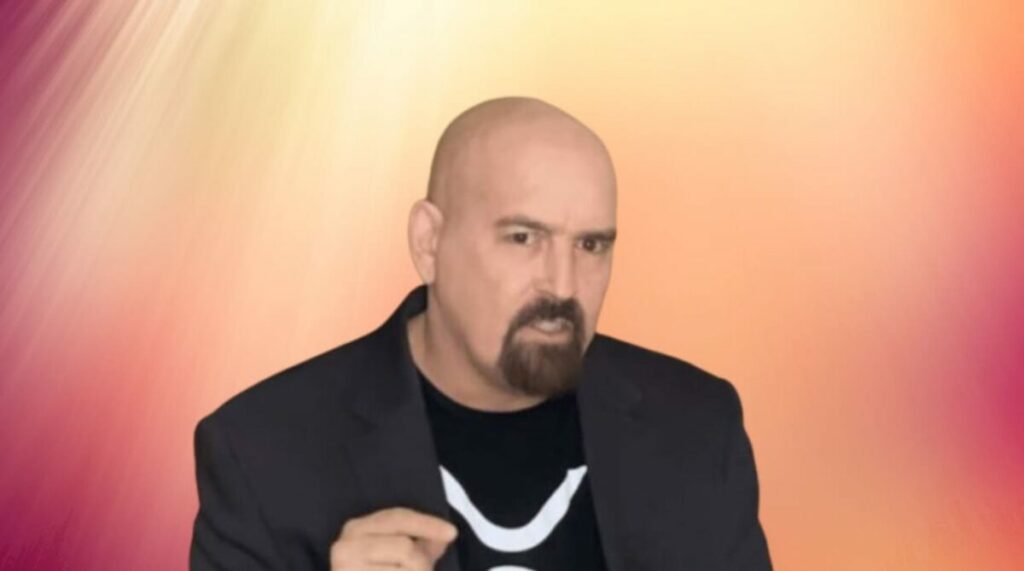

John Deaton, a prominent pro-XRP lawyer, bets big on another Ripple victory after the United States Securities and Exchange Commission (SEC) expressed it will appeal the partial legal win notched by Ripple in July.

Ripple (XRP) Won’t Shy away from SEC Appeal

On August 7, Deaton took to Twitter to express his optimism, hinting that Ripple (XRP) won’t shy away from the SEC’s likely appeal after Judge Analisa Torres ruled that the company did not violate securities laws in offering its native token XRP to retail investors except for instances when it was sold to institutions to raise funds.

Excellent 🧵 explaining that Torres didn’t make a distinction between the different sales out of thin air. She took each type of sale CHOSEN and DEFINED by the SEC and applied the Howey test. I’m willing to bet significant funds she doesn’t get reversed on appeal. https://t.co/5jAfwusrng

— John E Deaton (@JohnEDeaton1) August 6, 2023

Deaton referenced a detailed thread that outlined the logical approach taken by Judge Torres in her ruling, which he sees as a sturdy basis for an unfavorable outcome for the SEC. He explained even if the SEC successfully challenges Torres’ application of the Howey Test, Torres could still rule the same way when looking at the Howey Test’s other factors, such as the “investment of money” and the existence of a “common enterprise.” The pro-XRP lawyer added,

“Torres didn’t make a distinction between the different sales out of thin air. She took each type of sale CHOSEN and DEFINED by the SEC and applied the Howey test. I’m willing to bet significant funds she doesn’t get reversed on appeal.”

“No Error” in the Recent Ripple Win against SEC

The pro-XRP lawyer responded in affirmation after Australian lawyer and digital asset enthusiast Bill Morgan claimed the SEC had categorized Ripple’s XRP sales into three distinct types, and Judge Torres decided to analyze each category separately.

The more I read the Torres decision the more I struggle to see the error. The source of the error cannot be the different treatment of the 3 categories of sales. As Torres J. noted it was the SEC who categorised these three types of sales./1 pic.twitter.com/cchLpSt1y2

— bill morgan (@Belisarius2020) August 6, 2023

Morgan concluded the judge found significant differences between the categories, particularly noting that institutional buyers signed contracts with Ripple, unlike buyers from programmatic sales, suggesting he sees no error in the judge’s ruling. The Australian lawyer tweeted,

“The judge recognized that the factual setting as a whole between institutional sales and programmatic sales was very different. Further, her reasoning shows that a reasonable investor in the position of institutional buyers was in a different situation than the reasonable investor in the position of a programmatic buyer.”

Previously, Ripple’s chief legal officer, Stuart Alderoty also echoed the same sentiments, asserting that an appeal by the SEC could see Ripple consolidate its victory over the regulator even further. He noted the XRP token does not constitute an investment contract and that the Ripple team would not flinch away from any appeal brought to the courts by the SEC. He said,

“We think the judge got that right, and we think that was a faithful application of the law, and I think a court of appeals will not only affirm that but maybe even amplify that to even a greater extent.”

US Judge Rejects Recent Ripple Court Ruling

The heated debate in the ongoing legal battle between the SEC and Ripple took a new twist after United States District Judge Jed Rakoff, who is overseeing the Securities and Exchange Commission (SEC) case against Terraform Labs, expressed contrasting views regarding the approach used in last month’s ruling in the Ripple vs SEC case.

Judge presiding over SEC/Terraform Labs case in new court filing rejects approach taken in Ripple ruling. Says he won't distinguish between crypto assets based on how they're sold — ie directly to institutional investors versus to retail investors on exchanges. pic.twitter.com/6ar0ocXjd8

— Ally Versprille (@allyversprille) July 31, 2023

Rakoff had strongly criticized the distinction made in the Ripple lawsuit between public and institutional sales, claiming the Howey test does not differentiate between purchasers based on the origin of their coins, as all purchasers could reasonably expect that they will profit based on the defendants’ efforts.

In addition, the Terraform Labs Judge specified the method of sale, whether directly to large, institutional investors or via secondary market transactions to retail investors, shouldn’t affect whether or not those coins are considered securities.