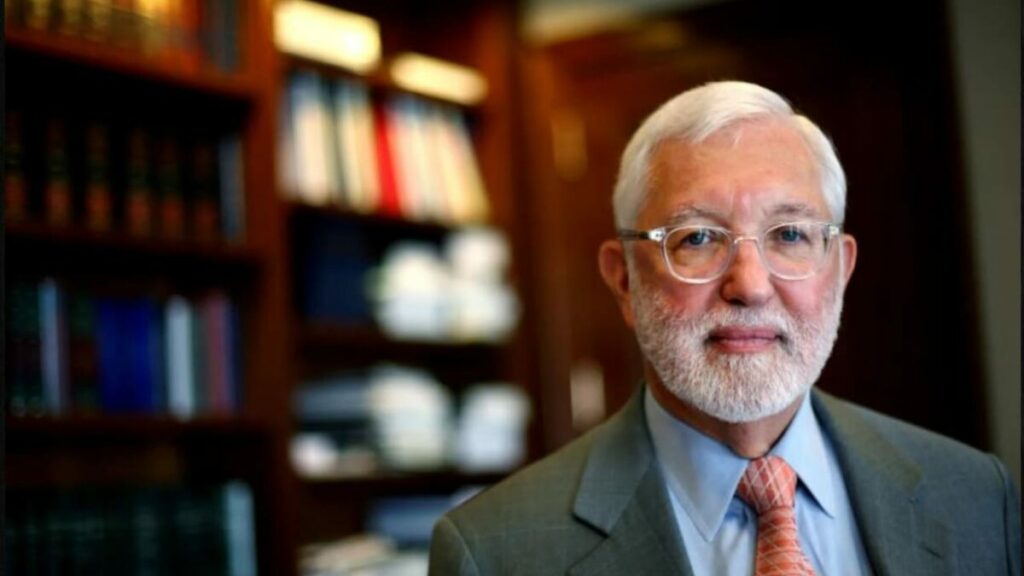

United States District Judge Jed Rakoff, who is overseeing the Securities and Exchange Commission (SEC) case against Terraform Labs, has expressed contrasting views regarding the approach used in last month’s ruling in the agency’s case against Ripple (XRP).

Newsflash: Ripple Decision Already in (Big) Trouble

SDNY District Judge Jed Rakoff today allowed the SEC to go forward with its case against Terraform Labs and founder Do Kwon. In doing so, Judge Rakoff specifically rejected the distinction made in the Ripple case between public… pic.twitter.com/JZZ8vukfFt

— John Reed Stark (@JohnReedStark) July 31, 2023

New Twist in the Tale

A new drama seems to have erupted in the ongoing lawsuit between the SEC and Ripple, the makers of XRP. Last month, Ripple notched a dramatic win against the American watchdog after Judge Analisa Torres ruled partially in favor of the company ruling that the XRP token is not a security when sold to the general public, but only in regard to programmatic sales on digital assets exchanges.

Despite the recent court decision, Rakoff, firmly rejected the distinction made in the Ripple lawsuit between public and institutional sales, delivering a significant blow to the ruling. In his view, the Howey test does not differentiate between purchasers based on the origin of their coins, as all purchasers could reasonably expect that they will profit based on the defendants’ efforts.

Judge presiding over SEC/Terraform Labs case in new court filing rejects approach taken in Ripple ruling. Says he won't distinguish between crypto assets based on how they're sold — ie directly to institutional investors versus to retail investors on exchanges. pic.twitter.com/6ar0ocXjd8

— Ally Versprille (@allyversprille) July 31, 2023

According to Rakoff, the method of sale, whether directly to large, institutional investors or via secondary market transactions to retail investors, shouldn’t affect whether or not those coins are considered securities. It seems, Rakoff’s views provide an alternate interpretation of how cryptocurrencies should be classified, taking into account other properties of the given asset instead of the manner of sale.

Judge Rejects Motion to Dismiss Terraform Case

The twist in the Ripple vs SEC started after the District Judge allowed the SEC to proceed with its case against Terraform Labs and founder Do Kwon. On August 1, John Reed Stark, a former SEC attorney in the agency’s Enforcement Division, took to Twitter to reveal Rakoff’s ruling on Terraform Labs’ motion to dismiss the SEC’s lawsuit against them.

He denied Terraform Labs’ motion to dismiss the SEC lawsuit, asserting that the regulatory watchdog has jurisdiction and a plausible claim that TerraUSD (UST), the Anchor Protocol, and LUNA may have violated securities laws. Following the decision, Rakoff also noted the cryptocurrency industry does not have the same “vast economic and political significance” as other regulated industries.

It is likely if Rakoff’s view is found persuasive, the SEC will have commanding support in its raging war against the digital assets industry. This might also bolster the regulatory’s conviction to appeal Judge Analisa Torres’ recent court ruling in the XRP case.

In the wake of the SEC’s lawsuit filings against Coinbase and Binance last month, alleging violations of securities laws, the United States is proving to be a challenging terrain for cryptocurrency companies.

Ripple CTO Weighs in on the Ruling

In response to the recent ruling, Ripple’s CTO, David Schwartz, expressed his reservations, noting that the decision seemed to rely on the unique properties of Terraform Labs’ scheme rather than the general characteristics of cryptocurrencies.

This ruling seems to be based no some very unsual properties of this particular scheme and not the way cryptocurrencies generally work. None of the below, the crux of the reasoning here, applies to typical cryptocurrencies as far as I can tell. pic.twitter.com/P41jiwlZaG

— David "JoelKatz" Schwartz (@JoelKatz) August 1, 2023

Moreover, Schwartz pointed out that the court’s rejection of the Ripple case did not appear to be solely based on a fundamental disagreement with its reasoning. Instead, there are key differences in the facts between the two cases. The CTO tweeted,

“This ruling seems to be based on some very unusual properties of this particular scheme and not the way cryptocurrencies generally work. None of the below, the crux of the reasoning here, applies to typical cryptocurrencies as far as I can tell.”

It is worth noting that despite XRP earning a partial victory in the SEC case, the matter remains a key driver in the valuation of the token. Following Rakoff’s rejection, XRP tanked over 2.16% in the last 24 hours to trade at $0.69. However, the digital token is up 1.46% over the past seven days. It seems, despite developments in the SEC case, XRP will continue to trade in alignment with the broader crypto market.