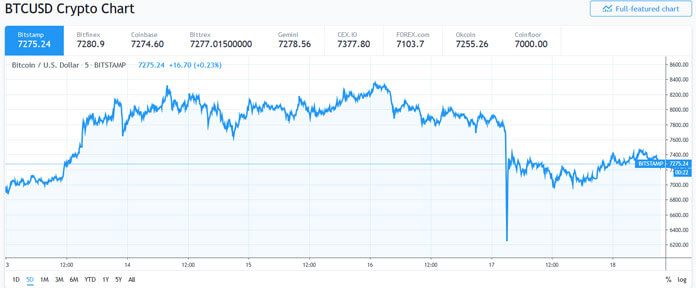

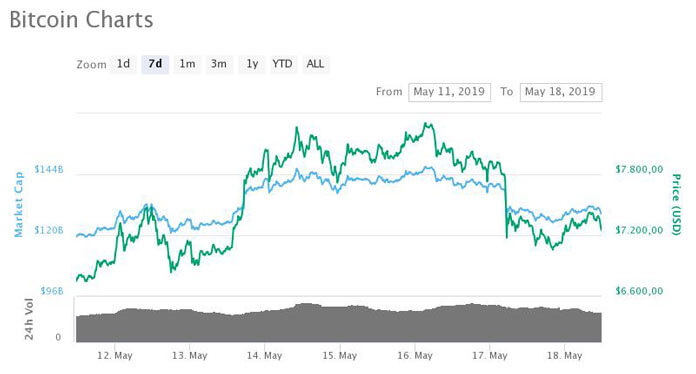

The cryptocurrency market is experiencing a correction after a significant rise in prices in recent days and weeks. Bitcoin [BTC], the leading cryptocurrency in market value, saw yesterday how its price fell by more than $ 1,700 on the Bitstamp stock exchange based in Luxembourg to an intraday low of $ 6,178. The fall of Bitstamp is considered a sudden crash if one considers that the price recovered immediately exceeding $ 7,000. The price is currently hovering around $ 7,359 in Coinmarketcap.

The market capitalization of Bitcoin fell along with the price by 10% similar to the price and currently stands at 130 billion dollars, from a maximum of around 140 billion dollars. Bitcoin has given some dominance in the market in recent days, as the price of several altcoins recovered to reach the recent rise in Bitcoin prices to more than $ 8,000.

The market in general was also corrected following the trend of Bitcoin, eliminating more than 40 billion only in the last 24 hours. Bitcoin accounts for about 40% of that loss, but the rest of the altcoin market also had significant market value corrections. Ethereum and Ripple‘s XRP, the second and third largest cryptocurrencies by market capitalization, respectively, recorded price corrections in the region of 12 and 11%, respectively. The spot price of Ethereum is currently $ 232, while that of XRP is $ 0.36.

Several of the remaining 20 major currencies listed on the Coinmarketcap website experienced losses in the range of 10 to 15%, with Stellar [XLM] registering the highest loss at 14.75%. Bitcoin Cash [BCH] took second place with a correction of 13.5%, same as Cardano [ADA] and Dash in the fourth position of the biggest losers in the top league coins with a correction of 13.3%.

It is not yet clear what may have caused the market correction with most analysts saying that Bitcoin has been trading in the overbought territory for the better part of the week. The RSI indicator, which shows a coins relative strength to maintain trend signaled that Bitcoin was due a correction ever since the start of the week, reaching a high of close to 90 in the RSI scale which is well into the overbought territory. Part of the reason why Bitcoin may have gone on a parabolic bull run in the past few days was due to the two major events held in New York this week – Blockchain Week NYC and CoinDesk’s Consensus 2019.

The Bitcoin price fall today has been attributed to a significant sell order for $35 million on the Bitstamp exchange right before the volatile movements. Speaking to CNBC in an earlier interview today, Jehan Chu, co-founder of Kenetic Capital said that,

“This last drop was likely caused by a combination of profit-taking and also algorithmic trading compounding the swift fall.” Chu added that we should expect the volatility to “continue for some time until institutional investors grow market volume.”