TL;DR

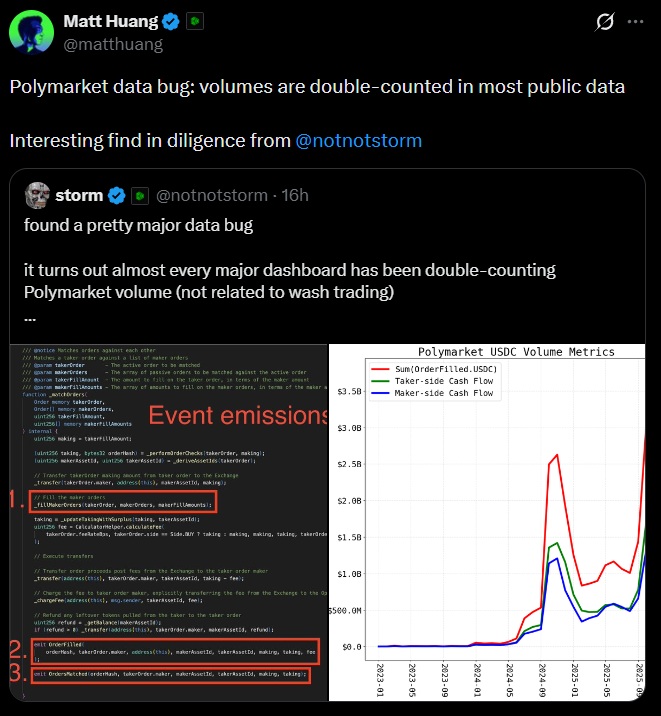

- A Paradigm investigation showed that Polymarket’s contracts emit two OrderFilled events per trade, creating duplicated volume on external dashboards.

- The analysis indicates that proper measurement requires using only one side of the trade, which brings monthly volumes down to about $1.25B instead of $2.5B.

- The review exposed rising tensions between both companies.

Polymarket became embroiled in a dispute after a Paradigm investigation uncovered a measurement issue that was doubling the platform’s reported volumes across third-party dashboards.

The analysis, conducted by Storm Slivkoff, argues that the platform’s smart contracts emit two OrderFilled events for every trade: one for the maker and one for the taker. That design generates a redundant representation of the same transaction when data aggregators sum all events without distinguishing their origin.

What Happened?

The issue doesn’t stem from the contracts or the underlying data. The problem emerges when dashboards process the event streams without separating trade sides. A $4.13 YES-market trade generates two $4.13 events, and external systems interpret that as $8.26 in volume. The gap compounds across thousands of daily trades and overstates real activity by roughly 100%. The same pattern appears in both the CTF Exchange and the NegRisk contracts, which share the same event-emission structure.

Slivkoff rebuilt the transactions with a simulator and audited the code to demonstrate that accurate measurement requires choosing a single side — maker or taker, but never both. With that method, Polymarket’s volumes for October and November 2024 land near $1.25B each month, half of what dashboards displayed before applying the corrections.

Polymarket Responds

The publication triggered immediate backlash. Polymarket argued that its official site already reports taker-side volume and follows the same standard used by Kalshi. The dispute isn’t about Polymarket’s website, but about how third parties interpret the raw event streams. DefiLlama, Allium Labs, and Blockworks confirmed they are updating their dashboards to remove double counting.

The debate also has competitive undertones because Paradigm is an investor in Kalshi, Polymarket’s main US rival. Analysts like Will Sheehan questioned the timing and warned the report could be seen as an attempt to damage a competitor. Others defended the research, noting that the mistake was understandable given the contract complexity and the range of operations involving swaps, splits, and YES-NO combinations.

Some observers suggest relying on metrics like open interest and fee revenue to get more accurate benchmarks.