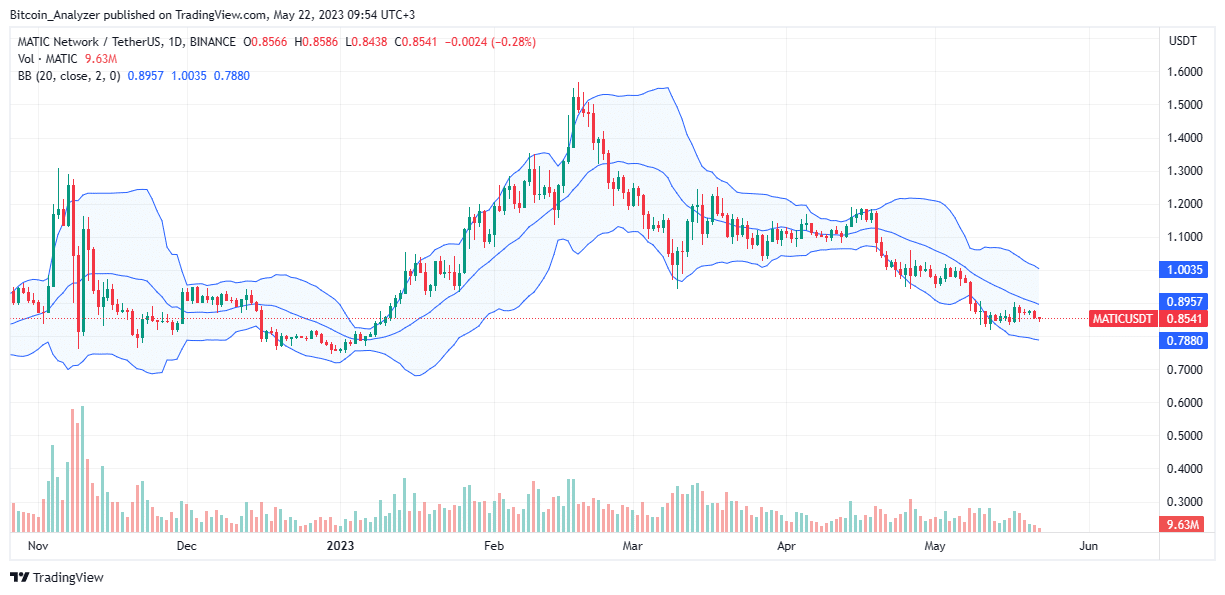

Polygon (MATIC) prices might have stabilized in the last few trading days, but MATIC is down 32% from March 2023 highs.

At spot rates, bears are resilient and could push the coin even lower.

A notable development in all this is that prices are suppressed despite gains on May 17, which was with rising volumes.

For this reason, MATIC’s immediate caps are at $0.905 and the middle BB, on the upper hand, and $0.850, on the lower end.

Scaling and Building

Polygon allows users, including developers, to deploy decentralized applications (dapps) in decentralized finance (DeFi), NFTs, and more, in a scalable and low-fee environment.

The scalability challenges mounting in Ethereum, and the possible deployment of scaling solutions in the mainnet could spark demand for Polygon.

Thus far, the focus lies on the zk-EVM, a solution to scale Ethereum through a layer-2 platform that prioritizes privacy.

Meanwhile, amid this development, Polygon has emerged as the most popular blockchain. While confirming this news, Ryan Watts, the president of Polygon Labs, said while he acknowledges that the platform has come a long way, they are still focused on empowering developers and long-term protocol strategies.

We've made significant strides at @0xPolygonLabs as shown in this chart.

Yet, the road ahead this year is the most exciting as we're focused on:

🚀Long-term protocol strategies

🤝Empowering every developer in our community

🔄Enabling flywheels in potential PMF areas pic.twitter.com/cVVb8bShMr

— Ryan Wyatt (@Fwiz) May 17, 2023

The rising popularity has seen companies deploy on Polygon. Some notable projects opting for the Ethereum sidechain include Nike, Reddit, and Starbucks. They have launched NFT projects and tokens on the platform.

Polygon (MATIC) Price Analysis

The MATIC consolidation continues.

As per the formation in the daily chart, the coin remains bearish. It risks plummeting below $0.85 if sellers press on.

Based on how candlestick arrangement, traders can wait for trend definition. Any loss that forces the coin below the current consolidation will be in confirmation of recent drops. MATIC may fall to $0.70 in that case, marking January 2023 lows.

Conversely, if MATIC is to recover from spot rates, there must be a convincing close above the May 17 highs of $0.905.

If trading volumes are at the same levels as May 17, MATIC could fly to $1 and later $1.20. This will be in a fresh recovery and resumption of the H1 2023 buy trend.

Technical charts courtesy of Trading View.

Disclaimer: The opinions expressed do not constitute investment advice. If you wish to make a purchase or investment we recommend that you always conduct your research.

If you found this article interesting, here you can find more Polygon News.