TL;DR

- Phantom Wallet has chosen to remain a private company, without launching a token or its own blockchain, prioritizing reinvestment in Solana.

- The wallet surpasses 7 million monthly active users and counts heavyweight investors such as Paradigm, a16z, and Sequoia, ensuring access to private capital.

- Remaining private allows Phantom to avoid the costs and obligations of a public listing, supporting organic growth.

Phantom Wallet decided not to go public, not to launch a token, and not to develop its own blockchain, defying the trend followed by companies like Kraken, Circle, and Gemini. CEO Brandon Millman explained that the company will stay private “for as long as it makes sense,” focusing on improving the user experience and strengthening its investments in Solana.

Since its launch in 2021, Phantom has become one of the fastest-growing crypto wallets, with over 7 million monthly active users and support for Solana, Ethereum, Polygon, and Sui. The company counts heavyweight investors such as Paradigm, a16z, and Sequoia Capital, ensuring access to private funding without resorting to public markets.

Why Phantom Doesn’t Need an IPO

Staying private allows Phantom to avoid the costs and obligations of a public listing, including issuing quarterly reports, board oversight, and maintaining compliance with demanding regulations.

Analysts say this approach provides flexibility to invest in products and pursue organic growth without the pressure of delivering immediate results to shareholders or exposure to stock market volatility. Additionally, issuing a token would create obligations to holders and added complexity that, combined with an IPO, Millman considers risky.

Phantom’s approach is also contrarian in terms of infrastructure: the company does not plan to launch its own blockchain. Instead, it will continue reinvesting in Solana and other existing ecosystems, leveraging their “fast and cheap” performance. According to Millman, no other chain is close to surpassing Solana in these features, while other niche blockchains may grow in specific applications without directly competing on speed and cost.

The Risk of Solana Dependence

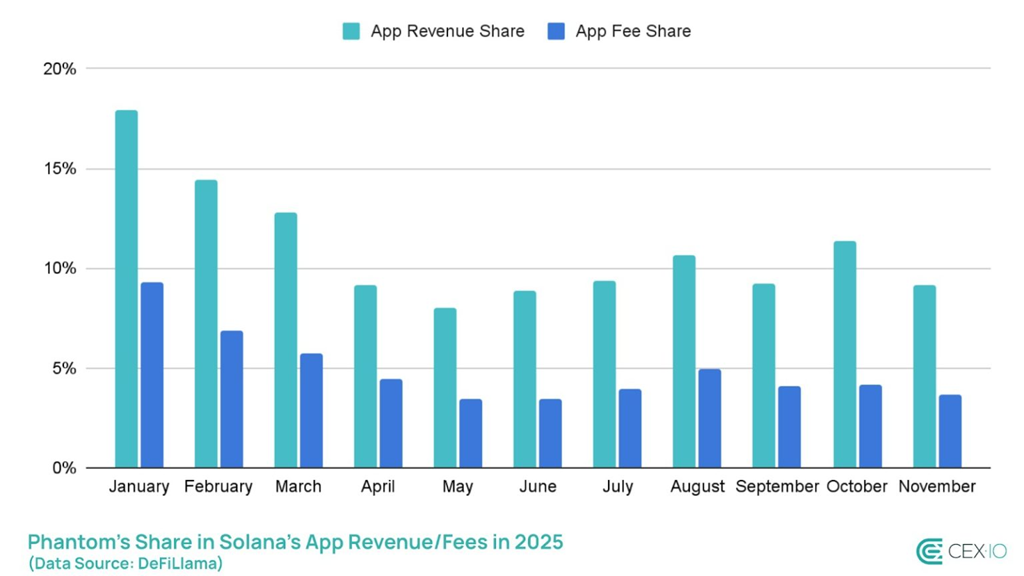

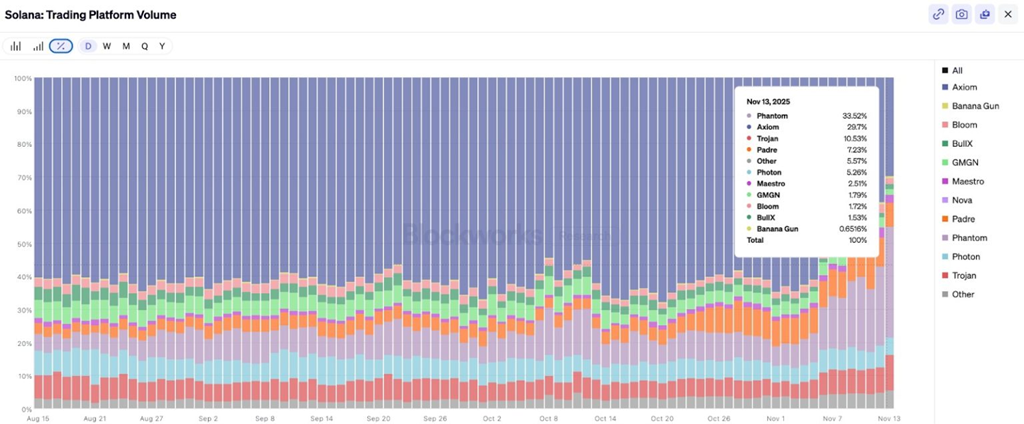

However, this strategy carries certain risks. Phantom is heavily dependent on Solana, with correlations of 97% in app revenue and 95% in transaction fees. Activity spikes benefit the wallet instantly, but any user migration or drop in Solana volume directly impacts its revenue.

Analysts believe the decision to remain private signals a shift in priorities for consumer-focused crypto startups, which now emphasize sustainability, product quality, and organic growth over speculation or public pressure. Internally, the wallet is also preparing an “IPO readiness” path, ensuring corporate discipline and adaptability without compromising its independence or innovation