TL;DR

- PancakeSwap and ListaDAO are monitoring two vaults managed by MEV Capital and Re7 Labs after detecting risk signals linked to the use of synthetic stablecoins as collateral.

- Vaults using USDX and sUSDX show unusually high borrowing rates and no repayments, increasing the likelihood of bad loans and losses for depositors.

- USDX is trading at $0.68, while its staked version, sUSDX, has dropped from $1.13 to $1.06, reflecting growing distrust in its backing.

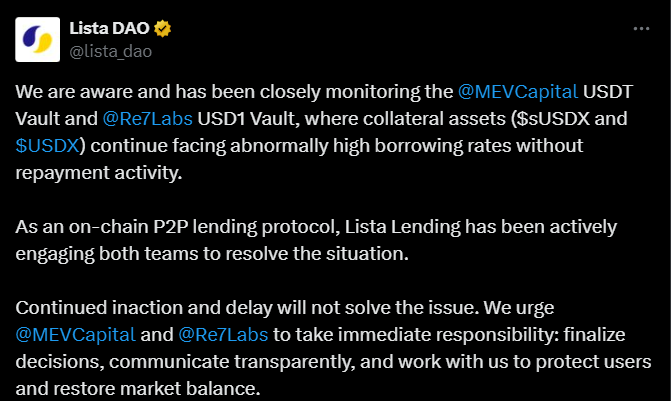

PancakeSwap and ListaDAO are closely monitoring two lending vaults managed by MEV Capital and Re7 Labs after detecting suspicious activity tied to the use of synthetic stablecoins as collateral.

Both PancakeSwap and ListaDAO warned that the vaults have unusually high lending rates and no repayment records, raising the probability of unpaid loans.

Is PancakeSwap’s Ecosystem at Risk?

The monitored vaults accept USDX and sUSDX as collateral — two assets whose recent performance has triggered alerts across the DeFi community. USDX, a freely tradable stablecoin, is currently priced at $0.68, well below its dollar peg. Its staked version, sUSDX, was trading at a slight premium of $1.13 but recently dropped to $1.06, signaling a loss of confidence in its backing. Since sUSDX cannot be freely redeemed, it is used as collateral to access more liquid stablecoins within these vaults.

ListaDAO and PancakeSwap voiced concerns about the rising borrowing rates and lack of repayments, urging MEV Capital and Re7 Labs to disclose the status of their positions transparently. The DAO warned that if the imbalance between loans and collateral is not addressed, depositors could suffer direct losses. Recent analyses suggest that over $750 million is currently locked in high-risk vaults across various DeFi platforms, where users are unable to withdraw their funds despite promised returns.

A Threat to Trust in DeFi Lending

This situation comes just days after the devaluation of XUSD, another synthetic stablecoin that lost its peg and triggered $93 million in losses. Re7 Labs had already been exposed to that asset and to the insolvency of Stream Finance, further heightening concerns about its current risk profile.

The issue is compounded by the fact that some supposedly low-risk protocols are allocating funds to higher-risk vaults to boost yields, exposing unsuspecting conservative users to potential losses. This practice threatens confidence in the decentralized lending ecosystem, where the pursuit of passive income through stablecoins remains one of the market’s main drivers.

According to the latest data, the DeFi ecosystem holds over $69 billion in total value locked, with $32 billion in Aave alone. However, the growing spread of unstable assets such as USDX and sUSDX underscores that the structural risks of decentralized credit remain far from resolved