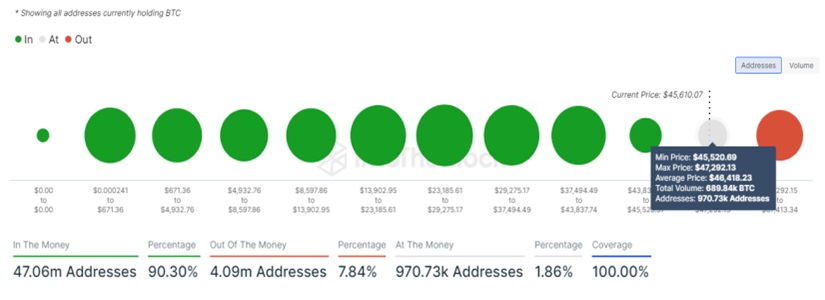

The growing anticipation surrounding the approval of a Bitcoin ETF in the United States has sparked a wave of optimism in the cryptocurrency market. Currently, over 90% of BTC holders, equivalent to about 970,000 addresses, are enjoying profits despite the recent turbulence caused by fake news about the product’s approval.

The event triggering this phenomenon was the false announcement of the ETF approval, posted on the hacked SEC Twitter account. As a result, Bitcoin prices reached a 19-month high, hitting $47,900, although they subsequently experienced a correction to $45,100. Nevertheless, despite this volatility, the cryptocurrency is holding around $45,420 at the time of writing this report.

This increase in the value of Bitcoin led to a notable transformation in investor sentiment. According to CryptoQuant data, at the beginning of 2023, less than half of BTC holders were in profit territory. However, the recent price rally, including a 160% increase in 2023 and a 50% increase in the last six months, catapulted a significant number of long-term investors, known as HODLers, into profitable positions.

Bitcoin Could Face a Strong Price Correction

Despite widespread enthusiasm, CryptoQuant analysts warn of the risks associated with the concentration of unrealized gains among BTC holders. They caution that this situation could set the stage for a significant price correction. Although demand for the Grayscale Bitcoin Trust (GBTC) remains strong, and trading volumes are increasing, indicating ongoing optimism about the potential ETF approval, the high concentration of unrealized gains is viewed with caution.

The CryptoQuant report highlights a potential scenario in which a Bitcoin price reaching $48,500, the average for holders with a 2-3 year investment horizon, could trigger a market correction. In such a case, estimated support levels would be between $34,000 and $30,000, representing a possible decline of 10 to 20%.

Although the BTC community is currently enjoying a period of widespread profits, analysts warn about the need for caution due to the concentration of unrealized gains, emphasizing the importance of closely monitoring market dynamics in the coming days to avoid further capital losses