TL;DR

- The Bitcoin options market is experiencing a wave of optimism, with traders betting on a price of $100,000 by the end of 2024.

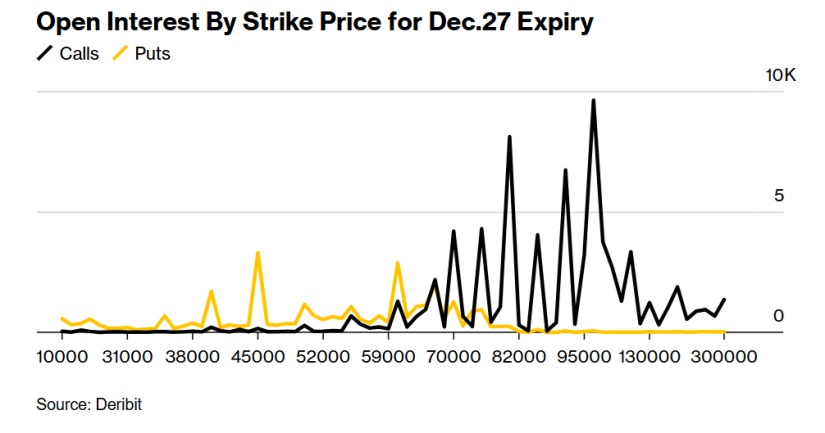

- According to data from Deribit, large bets are being placed on a Bitcoin call option at $100,000 expiring on December 27.

- BTC reached a new high of over $84,900 on November 11, which has increased investor confidence.

The Bitcoin options market is going through a wave of optimism. Many traders are betting on a price of $100,000 for the cryptocurrency by the end of 2024.

The growth in bets is a result of Donald Trump’s victory in the U.S. presidential elections, which has generated expectations of a more favorable environment for cryptocurrencies under his administration.

According to data from the Deribit options exchange, large bets are being placed on a Bitcoin call option expiring on December 27, 2024. This option, with an estimated value of $100,000, has seen a 30% increase in value over the past few weeks, making it one of the most notable and profitable trades in the market.

The Relationship Between Bitcoin and Trump

As of November 11, approximately 9,635 BTC, worth around $780 million, are betting that the price will reach that figure by the end of the year. Deribit estimates the probability of this scenario materializing at 18.6%.

Bitcoin surpassed $84,900 for the first time on November 11 and continues to reach new highs, which has only increased investor confidence. Its rise is inevitably linked to Donald Trump’s victory.

The president-elect has assured that policies will be implemented to favor its growth, such as the creation of a Bitcoin reserve and the dismissal of Gary Gensler, chairman of the U.S. Securities and Exchange Commission (SEC), who has been a constant obstacle for the crypto industry.

Doubts due to Geopolitical Conflicts

Despite the enthusiasm, some analysts remain cautious. Although the Bitcoin futures market is seeing an increase in institutional interest, with a 12% rise in open contracts since November 5, Bitcoin’s funding rate remains low compared to its previous peaks. Additionally, there are doubts about the level of commitment Trump will have with the crypto industry once in office, given that other geopolitical issues, such as the conflicts in Ukraine and the Middle East, could divert his attention