TL;DR

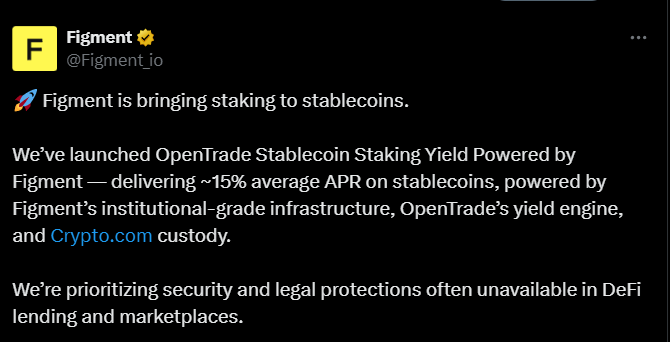

- OpenTrade introduced a product that uses Solana staking and a price hedge to deliver institutional-grade stablecoin yield.

- It combines a stablecoin deposit with a SOL position and a perpetual futures hedge that neutralizes token exposure and brings the yield close to 15% APR.

- The structure integrates a dedicated validator, segregated custody from Crypto.com, and a hedge operated by OpenTrade.

OpenTrade introduced a product that uses Solana staking and a price hedge to offer stablecoin yield to institutional clients.

How Does This Product Work?

The model combines a stablecoin deposit with a SOL position managed by Figment and a perpetual futures hedge that offsets exposure to the token. This setup makes it possible to generate a yield near 15% APR without relying on on-chain lending markets and without turning the user into a lender to third parties.

The user deposits a stablecoin and earns yield sourced from SOL staking rewards plus the outcome of the hedge. Figment manages a dedicated validator and prioritizes stable operations with controls designed for institutional requirements. OpenTrade executes the hedge using futures to keep risk within a defined range. Crypto.com holds the SOL in segregated accounts and grants the client a security interest to isolate the assets from the exchange’s operational funds.

The operational flow is straightforward. The client deposits a stablecoin into the OpenTrade vault. The platform acquires SOL, delegates it to Figment’s validator, and opens the hedge. The structure begins generating yield immediately and allows withdrawals without lock-ups. The user never interacts with Solana tools or derivatives markets; they receive net yield in stablecoins and track performance directly from the OpenTrade platform.

OpenTrade Addresses Demand From Exchanges and Other Platforms

The three companies aim to meet the demand from exchanges, custodians, and platforms that need to generate stable returns without relying on lending to unknown entities. The product targets institutions that require counterparty identification, segregated custody, and auditability. The hedge reduces sensitivity to SOL’s price and keeps the yield stream stable.

The result is a product that combines staking, derivatives, and custody in a single system designed for institutions. Its sustainability will depend on validator stability, futures costs, and the liquidity available to open and close hedges under stressed market conditions.