TL;DR

- Ondo Finance introduced the Global Markets Alliance, a network bringing together wallets, exchanges, and custodians to unify standards for tokenizing real-world assets.

- The alliance is working on shared rules for interoperability and institutional custody, aiming to make direct investments in U.S. securities more accessible.

- Bitget, Trust Wallet, Jupiter, BitGo, and Fireblocks will take on key roles in self-custody, liquidity, and regulated custody, integrating traditional and crypto assets within a single infrastructure.

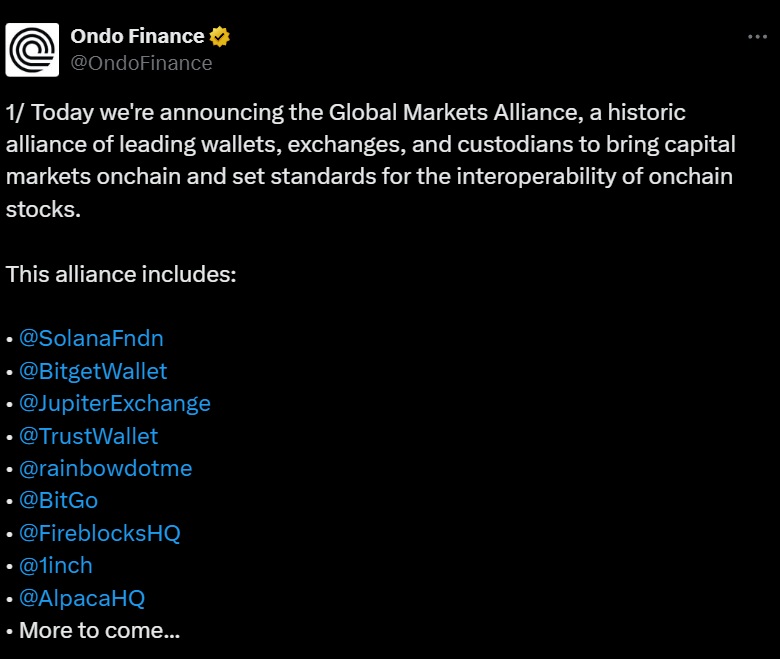

Ondo Finance announced the creation of the Global Markets Alliance, an initiative that brings together wallets, exchanges, and custodians to establish common standards for the tokenization of real-world assets.

The alliance includes Solana Foundation, Bitget Wallet, Trust Wallet, Rainbow Wallet, Jupiter, BitGo, Fireblocks, 1inch, and Alpaca. It seeks to accelerate the adoption of tokenized securities by defining shared technical and compliance frameworks that allow these assets to integrate into conventional crypto platforms.

Ondo’s plan aims to tackle one of the financial market’s long-standing challenges: restricted access and the lack of interoperability between products. To address this, the alliance is focused on enabling seamless and secure transfers of tokenized assets between services, improving liquidity, and ensuring custody practices that meet institutional standards.

Ondo Global Markets: Investing in the United States

At the same time, Ondo Finance is preparing to launch Ondo Global Markets, a platform that will let users outside the United States invest directly in U.S. stocks, ETFs, and mutual funds through integrated wallets. This initiative will allow apps and exchanges to offer traditional financial products alongside crypto assets within a single infrastructure.

Each member of the alliance has taken on a specific role. Bitget Wallet, Trust Wallet, and Rainbow Wallet will adopt Ondo’s tokenized asset standards to enable secure, self-custodial access. Jupiter and 1inch will contribute liquidity tools and programmatic trading services. BitGo and Fireblocks will deliver institutional-grade custody and off-exchange settlement solutions, a key component for replicating the dynamics of conventional financial markets. Alpaca, meanwhile, will build brokerage infrastructure tailored for tokenized securities.

Toward a New Financial Ecosystem

Company representatives agreed that tokenized assets not only open up a new range of investment opportunities but also transform financial operations by adding speed, transparency, and programmability over decentralized infrastructure. They also noted that wallets will play a central role in this shift, becoming the main gateway for accessing both traditional and tokenized products through a single interface.

Through the Global Markets Alliance, Ondo aims to lay the groundwork for a more open global financial environment, where geographic and regulatory barriers give way to secure, compatible, and accessible onchain solutions for any user with an internet connection