TL;DR

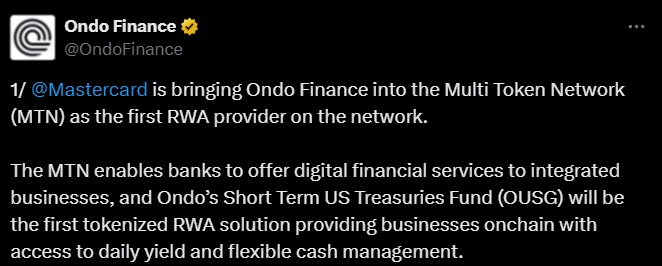

- Ondo Finance has partnered with Mastercard to integrate its tokenized assets into the Multi-Token Network (MTN) platform.

- The integration allows businesses to manage their tokenized assets without the need for stablecoins or traditional settlement windows.

- The OUSG fund, backed by high-level assets, provides flexibility, control, and new commercial financing opportunities.

Ondo Finance has arranged a collaboration with Mastercard, integrating its tokenized asset technology into the company’s Multi-Token Network (MTN) platform.

This partnership aims to facilitate businesses’ access to tokenized digital assets, specifically short-term U.S. government bonds, a category traditionally inaccessible through blockchain systems. Thanks to this integration, businesses working with Ondo will be able to manage their tokenized assets without needing to rely on stablecoins or traditional settlement windows.

What are the Advantages of Ondo Finance Integration with MTN?

Ondo’s integration into Mastercard’s MTN will allow clients to earn daily returns from tokenized bonds, with subscriptions and redemptions open 24/7. Additionally, the integration will be crucial for connecting a private payments network with tokenized assets on a public blockchain, a rare occurrence in the financial sector to date. This direct connection enables businesses to manage their liquidity and working capital more efficiently.

Ondo Finance’s Short-Term US Government Treasuries Fund (OUSG) is the primary tokenized asset that will be integrated into MTN. OUSG offers a range of advantages for businesses, such as lower costs compared to traditional investment options, the ability to perform transactions 24/7, and daily returns, providing unprecedented flexibility and control over cash management.

OUSG: Flexibility, Returns, and Security

Additionally, the security of OUSG is guaranteed by the backing of high-level assets, such as U.S. government bonds and other funds from renowned institutions, ensuring the stability of the product. This integration not only improves cash management but also opens up new opportunities, such as commercial financing and working capital optimization.

With Mastercard’s vision of creating a secure and scalable infrastructure for digital transactions, the collaboration with Ondo will be decisive in achieving a deeper integration of tokenized assets into traditional finance