Hedge funds are adopting a reduced-risk stance ahead of the Fed’s December meeting. On-chain data shows a decline in BTC balances on exchanges and a rise in USDT and USDC reserves, a signal that institutional capital is unwinding positions and building stable liquidity before the Federal Reserve’s decision.

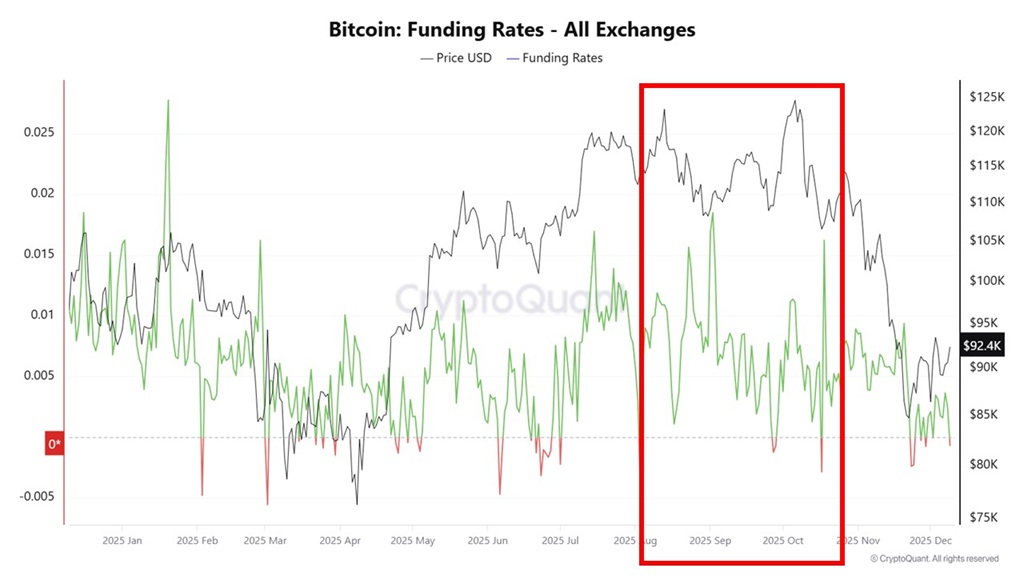

The increase in stablecoin reserves aligns with a historical pattern: rate-cut expectations, a pre-event rally, and a post-announcement pullback driven by deleveraging. Between August and October 2025, funding rates spiked as short-term traders piled into long positions, then collapsed after the FOMC announcement, right as BTC set a local peak and began to retreat.

The same structure is emerging now. CME futures open interest has stalled, whale spot holdings remain flat, and stablecoin inflows are accelerating. Professional capital is not trying to predict the outcome; it is preparing for any scenario. Volatility typically expands during FOMC week, and the key is to have a defined risk plan in place before the announcement arrives.

Disclaimer: Crypto Economy Flash News are based on verified public and official sources. Their purpose is to provide fast, factual updates about relevant events in the crypto and blockchain ecosystem.

This information does not constitute financial advice or investment recommendation. Readers are encouraged to verify all details through official project channels before making any related decisions.