TL;DR

- Obex raised $37 million to incubate real-world asset-backed stablecoins, in partnership with Framework Ventures, LayerZero, and Sky.

- The incubator offers a 12-week program providing capital, technical resources, and access to Sky’s infrastructure.

- Sky will allocate up to $2.5 billion in USDS to projects that meet risk and governance requirements.

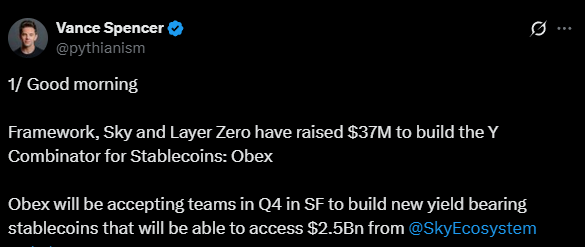

Obex, a new crypto incubator, raised $37 million to develop the next generation of yield-generating stablecoins, led by Framework Ventures, LayerZero, and the Sky ecosystem.

The initiative aims to bring real-world asset-backed strategies on-chain with institutional-grade risk controls, avoiding failures that have affected some synthetic stablecoins.

The incubator will focus on stablecoins backed by high-quality collateral, including tokenized compute credits, municipal-scale energy assets, and loans to large fintechs. Obex will run a 12-week program for early-stage teams, providing capital, technical resources, and access to Sky’s infrastructure.

Sky as Capital Allocator

Sky, formerly known as MakerDAO and the entity behind the DAI and USDS stablecoins with a combined market cap of $9 billion, will act as the capital allocator. Teams that meet risk and governance standards may access up to $2.5 billion in USDS to develop their projects.

Vance Spencer, co-founder of Framework Ventures, described Obex as a “Y Combinator for stablecoins,” highlighting that the initiative aims to fill an infrastructure gap to ensure new stablecoins are safe and scalable. Spencer noted that while the stablecoin market could reach a trillion dollars, yield-bearing stablecoins are growing even faster.

Obex Aims to Avoid Synthetic Stablecoin Failures

The program seeks to prevent issues that recently affected synthetic stablecoins, such as Stream Finance’s USDX or Elixir’s deUSD, which lost their peg following failures in decentralized protocols. By focusing on high-quality collateral and institutional-grade controls, Obex aims to deliver projects that generate yield safely.

Obex combines funding, technical oversight, and access to infrastructure designed to accelerate the development of reliable stablecoins, positioning itself as a reference in creating digital assets tied to real-world resources and as a key tool for the evolution of the blockchain industry