TL;DR

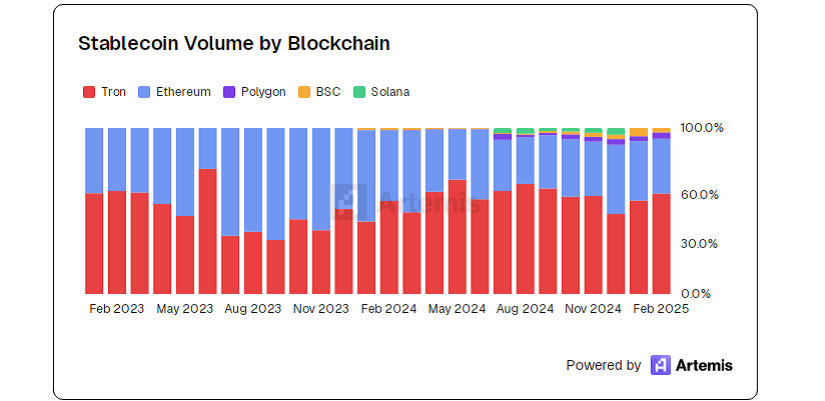

- Tether (USDT) accounts for 90% of global stablecoin payment volume, with the Tron network leading as the main settlement layer, hosting around 60% of all transactions.

- A report by Artemis, backed by Dragonfly and Castle Island Ventures, estimates the stablecoin payment market is moving over $72 billion annually.

- These figures confirm USDT’s dominant role, particularly in emerging economies.

A recent report conducted by Artemis, in partnership with investment firms Dragonfly and Castle Island Ventures, reveals a striking fact: 90% of payment transaction volume using stablecoins is processed through USDT, the digital asset issued by Tether. Tron, a blockchain known for its low fees and fast processing times, has emerged as the top choice for settlement, capturing nearly 60% of all transactions, far surpassing Ethereum and Binance Smart Chain.

The data was collected from 31 companies actively operating in the stablecoin payments ecosystem. As of February 2025, the annualized payment volume had surpassed $72 billion, a figure that underscores the steady expansion of these digital financial tools. While stablecoins were initially created to facilitate crypto trading, they have evolved into a legitimate solution for peer-to-peer transfers, business transactions, and even institutional payments. This shift reflects a maturing market where the demand for speed, affordability, and reliability is now the priority for millions of users and companies worldwide.

Real Adoption in Emerging Markets and Operational Advantages

Beyond the raw numbers, the report highlights that Tether’s dominance is most apparent in countries facing constant economic instability. In places like Argentina and Brazil, people don’t talk about “using stablecoins”, they simply say “we use Tether.” In these regions, USDT is viewed as a trustworthy alternative to holding physical dollars, solidifying its role as a daily medium of exchange.

Tron, for its part, has gained favor among companies due to its operational efficiency and low costs. According to Rob Hadick, a partner at Dragonfly, firms using stablecoins for payments rarely concern themselves with which blockchain is used, as long as it’s fast and inexpensive. In that regard, Tron checks both boxes and currently hosts more than $60 billion worth of USDT on its network.

While USDC, issued by Circle, has gained market share in terms of issuance, it has not reached the same level of adoption for real-world payments. This reinforces a growing truth in the industry: in practice, users care more about usability, speed, and brand familiarity than about the token’s institutional origin. Mass adoption doesn’t wait for approval, it simply happens.