TL;DR

- Moody’s warns that the rapid expansion of tokenized funds exposes the system to operational, legal, and technological security risks.

- The lack of experience among fund managers and the use of public, permissionless blockchains increase vulnerability to failures and attacks.

- They recommend allowing redemptions in both fiat and stablecoins, and strengthening legal documentation according to each jurisdiction.

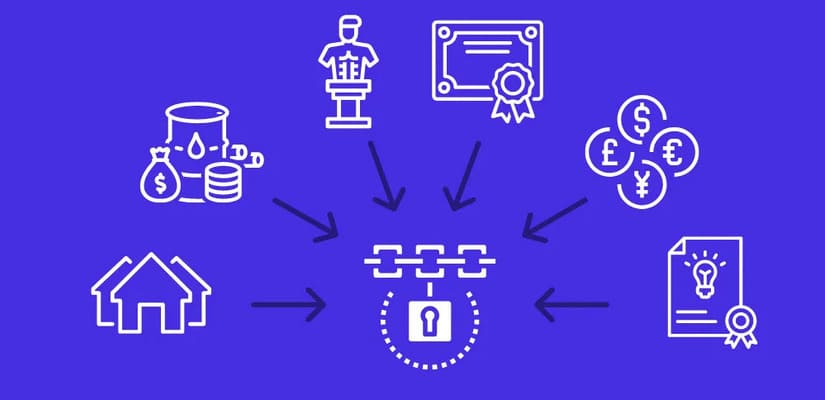

Tokenization of funds is growing rapidly, but the swift advancement of this technology also brings a series of risks that should not be overlooked.

This was highlighted by Moody’s Ratings in a recent report analyzing the technical, operational, and legal vulnerabilities of these financial instruments. According to the agency, using blockchain technology to represent traditional assets can improve transparency and accessibility, but it also presents challenges regarding system security and stability.

What Problems Did Moody’s Identify?

One of the main issues identified is the limited experience of many managers in this emerging environment. With small teams and short track records, funds can become too reliant on a few individuals. If one of these key members leaves or if the governance structure is weak, the fund’s operation could be compromised. Moody’s suggests diversifying responsibilities and strengthening internal mechanisms to avoid such situations.

The report also points out that smart contracts, while useful for automating operations, pose a technical risk. Coding errors or potential attacks can affect the normal functioning of the funds. Moreover, using public, permissionless blockchains increases exposure to vulnerabilities. In response, Moody’s recommends conducting thorough audits and keeping off-chain backups to reduce the impact of potential failures.

Redemptions in Fiat and Stablecoins

Another critical point is the redemption mechanisms. The ability to convert tokens into liquid money is essential for investors, but it can become fragile in times of stress. The agency advises allowing withdrawals in both fiat currency and stablecoins, which helps mitigate the impact of a potential drop in asset value or network outages.

Finally, operating tokenized funds across different jurisdictions adds another layer of complexity. Regulatory differences can become legal obstacles for investors trying to assert their rights. Although some funds adopt structures designed to ensure a direct link to the underlying assets, their effectiveness depends on local legal frameworks and the specific documentation of each product.