TL;DR

- Metaplanet has expanded its Bitcoin portfolio with a fresh 780 BTC buy worth $92.5 million, pushing its total holdings to 17,132 BTC valued at about $2 billion.

- The Tokyo-based company remains among the world’s top corporate Bitcoin holders outside the US.

- Its ambitious target to reach 210,000 BTC by 2027 signals a bold push to secure 1% of Bitcoin’s total supply.

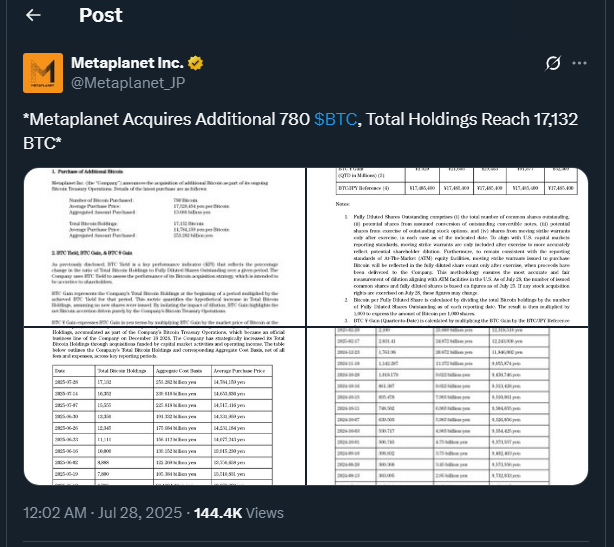

Metaplanet, theTokyo-listed investment firm, has doubled down on its Bitcoin strategy with another sizeable purchase. On Monday, the company confirmed it spent roughly $92.5 million to acquire an additional 780 BTC at an average price of $118,622 per coin. This move raises its total stash to an impressive 17,132 BTC, placing it firmly among the top non-US corporate holders of Bitcoin.

The company’s aggressive approach to Bitcoin accumulation began just over a year ago, but it has rapidly evolved into a core pillar of its growth plan. CEO Simon Gerovich recently shared that Metaplanet’s average cost basis sits near $101,030 per Bitcoin, a figure that reflects disciplined buying across fluctuating market conditions. While Bitcoin continues to trade just above Metaplanet’s latest entry price, the firm remains confident in its long-term potential.

Expanding Ambitions Beyond Japan

Metaplanet’s strategy extends far beyond simply stockpiling Bitcoin. Reports indicate the company aims to leverage its digital assets to finance acquisitions of cash-generating businesses, including the possibility of launching a digital bank in Japan. By using Bitcoin as a reserve asset and collateral, Metaplanet hopes to future-proof its balance sheet against inflation and currency risks.

In its latest quarterly report, the company revealed that its Bitcoin-focused business line generated nearly 1.1 billion yen ($7.6 million) in revenue during the second quarter of this year, marking a year-over-year growth of 42.4%. Despite recent volatility in crypto markets, Metaplanet’s stock price has surged over 250% since January, underlining investor confidence in its digital asset strategy.

Rising Position Among Global Bitcoin Treasuries

Currently ranking seventh among corporate Bitcoin holders worldwide, Metaplanet sits just behind Trump Media & Technology Group and comfortably ahead of Galaxy Digital Holdings. While still dwarfed by MicroStrategy’s massive 607,770 BTC, Metaplanet’s plan to reach 210,000 BTC by the end of 2027 demonstrates its commitment to becoming a major force in the crypto treasury landscape.

Bitcoin has shown renewed resilience, trading at around $119,200 at the time of writing. For Metaplanet, the recent price uptick supports its long-term vision of using Bitcoin as both a strategic reserve and a tool for corporate expansion.