TL;DR

- Metaplanet has expanded its Bitcoin holdings to 20,000 BTC after acquiring an additional 1,009 coins for $112 million.

- The company now holds roughly $2.14 billion in BTC at an average purchase price near $102,800.

- Alongside its aggressive accumulation, Metaplanet reported a quarterly BTC Yield of 30.7%, reinforcing its conviction that Bitcoin remains the best-performing treasury reserve asset in the long term.

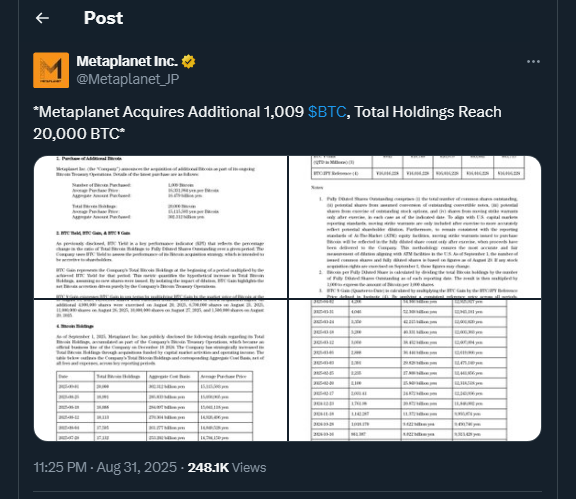

Metaplanet has taken another major step in its Bitcoin strategy, announcing a new purchase of 1,009 BTC worth $112 million. This acquisition raises the firm’s total reserves to 20,000 BTC, cementing its place as one of the largest publicly listed Bitcoin holders in Asia. At current market prices, the holdings are valued at more than $2.1 billion. The company continues to average its entry cost effectively, with all-time purchases made at a price below the current market level.

Bitcoin Accumulation Accelerates In 2025

Throughout 2025, Metaplanet has stepped up its Bitcoin accumulation strategy. In just two months, its reserves jumped from 13,000 BTC at the end of June to 20,000 BTC by September. The expansion has been funded through a mix of operating income and capital market activities, underlining the company’s confidence in Bitcoin as a treasury asset.

The firm also reported a BTC Yield of 30.7% for the quarter ending September 1, a metric it uses to measure Bitcoin holdings relative to fully diluted shares. Earlier in the year, the yield had surged past 300%, highlighting the impact of Bitcoin’s appreciation and Metaplanet’s aggressive buying strategy. Management has emphasized that these internal metrics serve as a benchmark to ensure Bitcoin acquisitions are accretive to shareholders.

Global Exposure And Strategic Partnerships

Metaplanet’s strategy has drawn comparisons to MicroStrategy in the United States, both companies making Bitcoin their primary reserve asset. By following this approach, Metaplanet positions itself as a pioneer in Japan’s corporate landscape, where conservative financial practices have historically dominated.

International attention has also grown after the company appointed Eric Trump as an advisor earlier this year. Trump is set to attend a shareholder meeting in Tokyo on Monday, signaling broader political and business support for Bitcoin adoption. His involvement aligns with the Trump family’s growing interest in crypto ventures, including mining and stablecoins, which could further globalize Metaplanet’s brand.

With inflationary pressures still a concern worldwide, Metaplanet continues to present Bitcoin not just as an alternative asset but as the foundation of a forward-looking corporate treasury model. The company’s unwavering commitment underscores the growing conviction among leading firms that Bitcoin is here to stay as a strategic reserve.