TL;DR

- Over $973 million in tokens will be unlocked between March 3 and March 8 across eight projects, with ENA leading with $855 million.

- These events coincide with the release of key economic reports in the U.S., including the March 7 jobs report.

- Market impact will depend on investor reaction and demand trends in a correction phase.

Over $973 million in cryptocurrencies will be released next week across various projects, which could have a certain impact on the market.

Eight protocols will execute unlocks between March 3 and March 8, distributing tokens to founding teams, private investors, and advisors. These events often attract attention and generate expectations of potential large-scale sales that may affect asset supply and demand.

Which Tokens Will Be Unlocked?

The largest unlock belongs to ENA, which will release approximately $855 million worth of tokens on March 5. This figure represents 65.93% of its circulating supply and marks a point where more than half of its tokens will be on the market. The scale of this release accounts for 88% of the total value unlocked during the week, likely influencing the asset’s price if beneficiaries choose to sell a significant portion of their holdings.

SUI ranks second with a $106.98 million unlock scheduled for March 3. This amount represents 1.24% of its circulating supply and adds to the tokens already released in the past. NEON, in turn, will release $4.12 million on March 7, increasing its circulation by 11.20%. Other projects, such as IOTA, AGI, SPELL, CETUS, and HFT, will also carry out smaller unlocks throughout the week.

Economic Reports to Watch

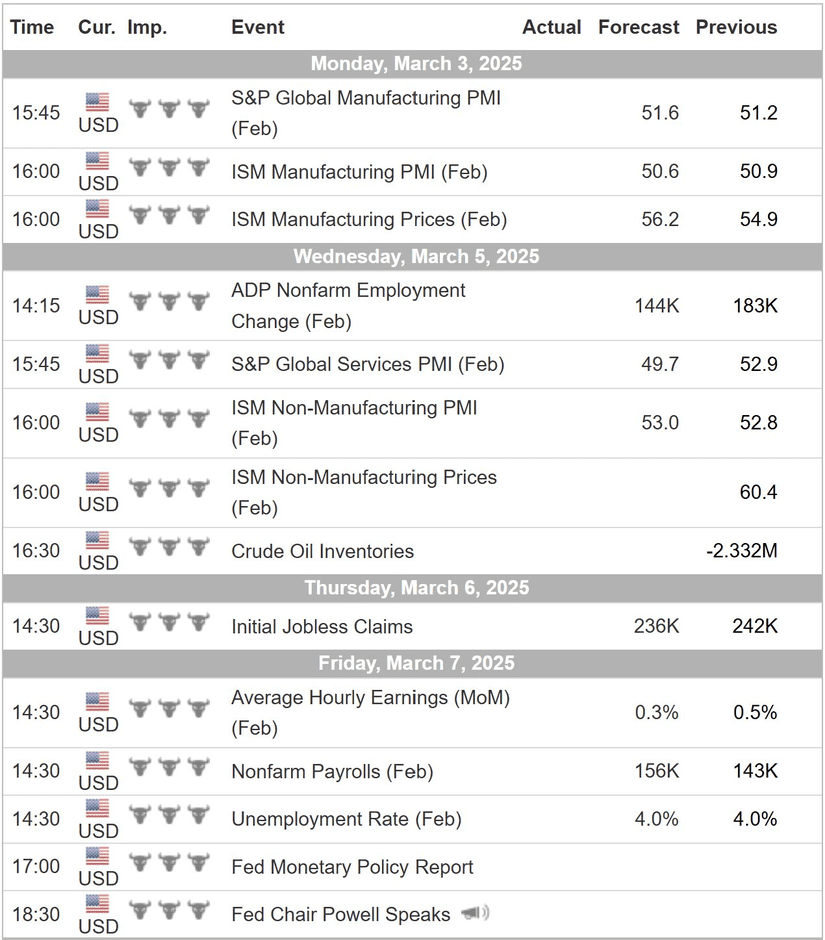

These events coincide with the release of key economic reports that could impact market sentiment. On March 7, the U.S. employment report will be published, including data on nonfarm payrolls, the unemployment rate, and wages. The results of this report may influence Federal Reserve policy expectations and affect the direction of risk assets, including cryptocurrencies.

Other economic indicators will be released throughout the week. On March 4, manufacturing PMI indexes will be published, while on March 6, the ADP employment report and data on the service sector will be released. Additionally, the weekly jobless claims report will be presented on Thursday, providing further insight into the U.S. labor market situation.

However, the market is already showing signs of correction, so the impact of these unlocks and reports will depend on investor reactions and demand behavior