TL;DR

- Bitcoin ETFs saw $1.2 billion in outflows last week.

- Solana ETFs attracted $136.5 million since their October launch.

- BTC and ETH prices rose despite ETF outflows.

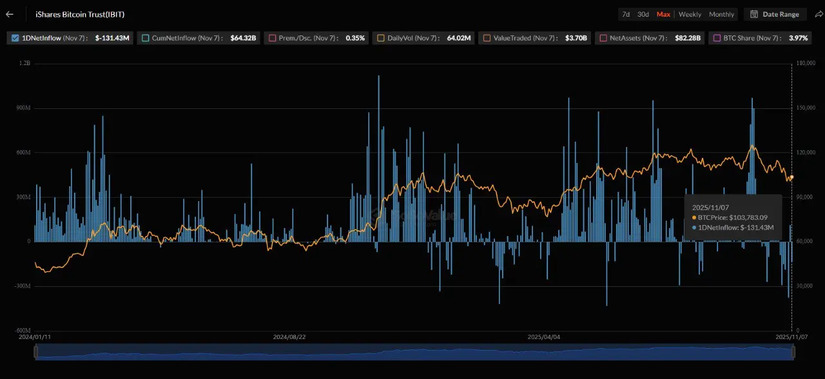

Bitcoin exchange-traded funds recorded $1.2 billion in outflows last week. Friday alone accounted for $558.44 million in withdrawals, marking the third-largest single-day outflow since spot Bitcoin ETFs launched in January. Fidelity’s FBTC led the retreat with $256 million in outflows, followed by Ark & 21Shares’ ARKB at $144.24 million. BlackRock’s iBIT saw $131.43 million leave the fund.

Grayscale’s GBTC and Bitwise’s BITB lost $15.44 million and $10.68 million, respectively. Seven other issuers—Grayscale BTC, VanEck HODL, Invesco BTCO, Valkyrie BRRR, Franklin EZBC, WisdomTree BTCW, and Hashdex—reported no activity on that day.

Ethereum ETFs also declined. They posted $46.62 million in outflows on Friday, pushing weekly outflows past $500 million. In contrast, Solana ETFs attracted $12.69 million that same day. Since their debut on October 28, Solana ETFs have seen uninterrupted inflows, accumulating $136.5 million by week’s end.

Market prices moved independently of fund flows

Bitcoin rose 4% in 24 hours to $106,371.49, trimming its weekly loss to 1.48%. Ethereum gained 4.92% over the same period, though it remained down 3.47% for the week at $3,607. Solana climbed 5.05% in 24 hours, cutting its seven-day drop to 4.62%. SOL trades at $167.69 and ranks sixth by market capitalization.

Wall Street’s appetite for crypto assets has not waned. BlackRock’s iBIT still holds $82.28 billion in net assets, the largest among all spot Bitcoin ETFs. Fidelity’s FBTC trails with $20.71 billion, and Grayscale’s GBTC holds $17.72 billion. Combined, the ten U.S. spot Bitcoin ETFs manage $138.08 billion.

Recent product expansions reflect continued institutional commitment. Fidelity and VanEck added new spot offerings. Bitwise and Grayscale rolled out the first U.S. Solana ETFs in late October. Those funds pulled in nearly $70 million on day one and now total just over $500 million in assets.

Five spot XRP ETFs—sponsored by Canary Capital, CoinShares, 21Shares, Franklin Templeton, and Bitwise—appeared last Friday on the Depository Trust & Clearing Corporation’s listing. Industry observers expect them to begin trading before November ends.

Nate Geraci, co-founder and president of Nova Dius Wealth, noted that the end of the federal government shutdown removes a procedural barrier. He suggested the first spot XRP ETF registered under the Securities Act of 1933 could debut within days.

The divergence between ETF outflows and price action suggests retail and institutional strategies are not moving in lockstep. Some investors exit positions through ETFs while others accumulate directly in spot markets. The pattern underscores a maturing market where price no longer hinges solely on one channel of demand.