TL;DR

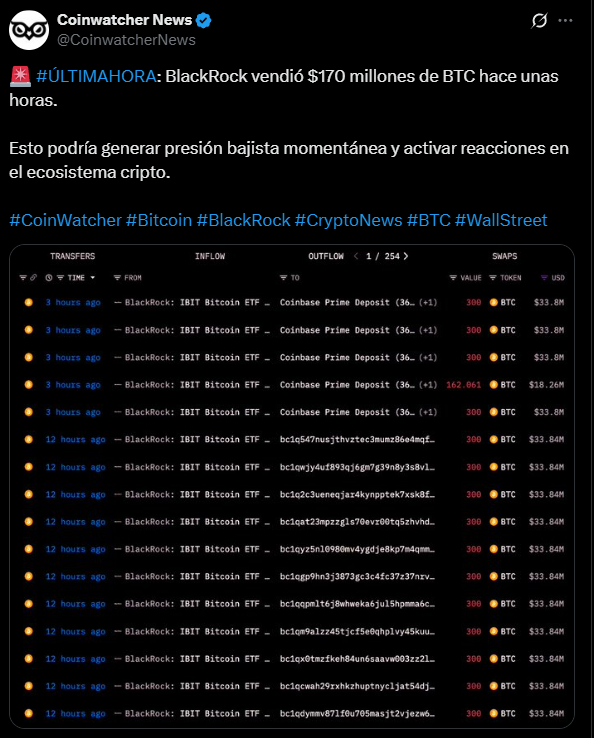

- BlackRock sold $170 million in Bitcoin through its IBIT ETF, triggering an immediate market reaction.

- The sale reflects investor outflows from the ETF; BlackRock acts as custodian, liquidating BTC to return cash to clients.

- In the short term, the operation increases supply and volatility, but the market’s ability to absorb it demonstrates liquidity, resilience, and ecosystem maturity.

BlackRock sold approximately $170 million in Bitcoin through its iShares Bitcoin Trust (IBIT) ETF. The on-chain transaction caused an immediate price drop and sparked debate over the stability of the crypto market.

The Sale Is Not a Strategic Decision by BlackRock

This sale is driven by ETF investor outflows, not by a strategic choice from BlackRock as an institution. The firm acts as custodian, liquidating the equivalent amount of BTC to return cash to clients when they sell their shares.

The scale of the sale stems from collective investor sentiment, likely driven by profit-taking after a bullish period or by macroeconomic factors that increase risk aversion.

Although the operation increases available supply and generates downward pressure, volatility, and potential liquidations of leveraged positions in the short term, its long-term interpretation is different. The market’s ability to absorb an institutional sale of this magnitude without collapsing demonstrates sufficient liquidity, high resilience, and the ecosystem’s maturity in handling large capital flows.

The Market Shows Its Resilience

The event also highlights the new dynamic between Wall Street and the crypto industry. ETF integration exposes the market to traditional capital inflows and outflows, normalizing sharp price movements from large purchases or sales. This reality shows that volatility does not necessarily signal a loss of confidence but reflects adaptation to a system where Bitcoin is already part of the institutional financial infrastructure.

BlackRock’s sale should not be interpreted as a signal of the end of the bull cycle. Beyond the immediate decline, it demonstrates that Bitcoin is fully integrated into traditional markets and that institutional adoption is solid. The true signal will come from the speed and strength with which the market recovers from this sale