TL;DR

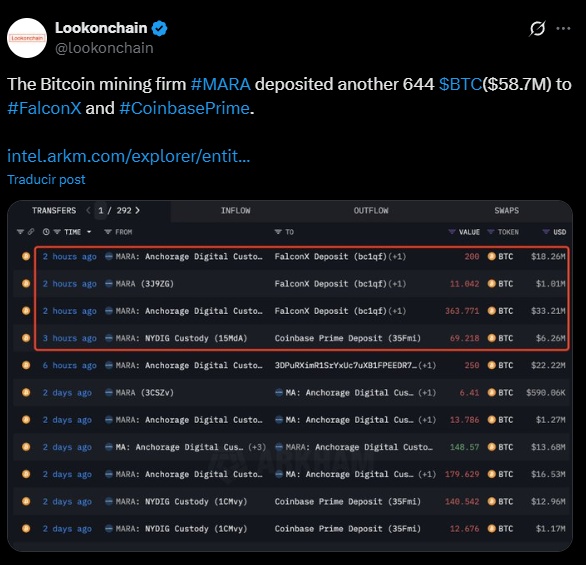

- Marathon sent 644 BTC valued at $58.7 million to FalconX and Coinbase Prime during November because it needed to adjust its treasury.

- The firm carried out a series of transfers to secure operational liquidity, as mining is generating lower returns per unit of hashing power.

- At the same time, it allocated 33% of its 52,850-BTC reserve to lending and asset management to generate additional income.

Marathon Digital is keeping a steady pace of Bitcoin transfers while the mining sector moves through a much more complex environment. The firm sent 644 BTC worth $58.7 million to FalconX and Coinbase Prime, a transaction it repeated several times throughout November.

Marathon carried out multiple and frequent movements toward exchanges and other brokerage platforms, and this sequence of transactions suggests the company is adjusting its treasury management, operational needs, or liquidity strategy as block-level Bitcoin mining revenue declines.

Bitcoin Mining Is Generating Minimal Profit

The mining industry is operating under pressure, with the sector working at a hashprice that has fallen to its lowest level since the index was created. Data from Hashrate Index showed the metric dropped to $38 in daily earnings per unit of hashing power, the weakest return since this benchmark has existed.

A block currently yields 3.15 BTC, and the sector requires more energy consumption and greater computing power to obtain results that a year ago demanded less capability and lower working capital. The mining economic model calls for rapid decision-making when profitability declines, and Marathon is adjusting its balance sheet to maintain liquidity without putting its core operations at risk.

Marathon Puts Its BTC Reserves to Work

However, these transfers do not imply immediate selling but instead reflect an internal shift in asset management. Marathon transferred more than 150 BTC to Coinbase Prime three days ago and, over the month, moved 2,348 BTC valued at more than $215 million to FalconX, Galaxy Digital, TwoPrime, and Coinbase Prime.

The company is managing its reserves because its Q3 financial report shows that revenue rose 92% year over year, reaching $252 million. However, that growth was supported by the change in the fair value of the assets and not by higher Bitcoin mining output. Production fell from 23.3 BTC per day to 22.5 BTC per day, and Marathon is seeking to offset that decrease through lending, active digital asset management, or the use of BTC as collateral. 33% of its treasury, equal to 17,357 BTC, is committed to these strategies.