TL;DR

- Mantra has launched the Mantra Ecosystem Fund (MEF) with $108,888,888 aimed at accelerating the growth of DeFi and real-world asset (RWA) tokenization projects.

- The fund will operate with an “open-arms” policy, supporting startups at any development stage over the next four years.

- Major institutional investors like BlackRock and Fidelity are already betting big on tokenization, reinforcing the potential of the ecosystem Mantra seeks to lead.

Mantra, the blockchain platform focused on real-world assets (RWA), has launched a $108 million fund to drive innovation in DeFi and asset tokenization. With this ambitious initiative, the company aims to support the development of groundbreaking solutions that bridge traditional finance and blockchain technology, backing entrepreneurs with disruptive, high-impact ideas.

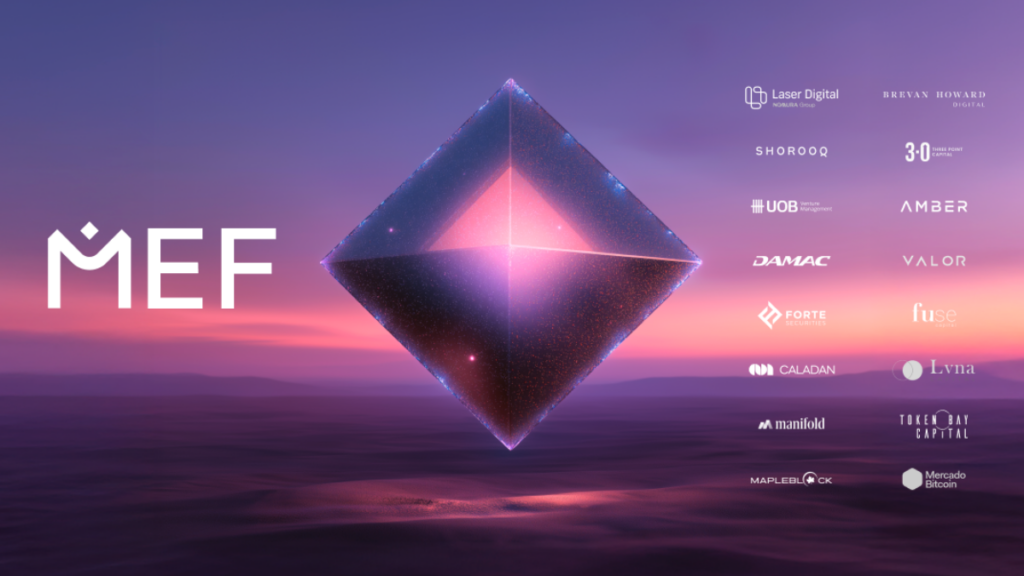

The Mantra Ecosystem Fund (MEF) will be deployed over a four-year period, supported by major institutional investors such as Laser Digital, Shorooq, Brevan Howard Digital, Valor Capital, and Amber Group. The strategy is straightforward: invest in scalable, high-potential blockchain projects regardless of their maturity level or geographic origin. This inclusive approach means both early-stage startups and more advanced ventures will be eligible for support.

The Perfect Timing for RWA Growth

The fund’s launch comes at a time when tokenized assets are gaining significant momentum amid global economic uncertainty and rising demand for asset-backed digital instruments. According to “RWA.xyz”, the market capitalization of RWAs exceeded $19.6 billion in April 2025, up from $17 billion in February, signaling robust and ongoing growth.

Institutional interest is skyrocketing. BlackRock’s digital liquidity fund “BUIDL” tripled in size within three weeks, reaching $1.87 billion. Meanwhile, Fidelity has filed with the SEC to tokenize its money market fund. These moves show that the world’s largest financial institutions are taking tokenization very seriously and beginning to integrate it into their core strategies.

Tokenized funds now manage over $1 billion in assets, driven by both traditional firms like BlackRock and Web3-native players such as Ondo Finance. Market forecasts suggest tokenized assets could surpass $10 trillion in value by 2030, with real estate likely making up nearly a third of that total.

A Bold Commitment to Crypto’s Future

Mantra hasn’t just committed capital, it has also secured a VASP license from Dubai’s Virtual Assets Regulatory Authority, becoming the first DeFi platform to receive that level of regulatory recognition. This powerful combination of regulation, funding, and technical innovation positions Mantra as a key player in the tokenized asset revolution.

In an industry still plagued by speculation, the MEF signals a shift toward real-world utility, regulatory clarity, and institutional credibility. Tokenization isn’t just a passing trend, it’s the bridge connecting traditional finance with the Web3 universe.