TL;DR

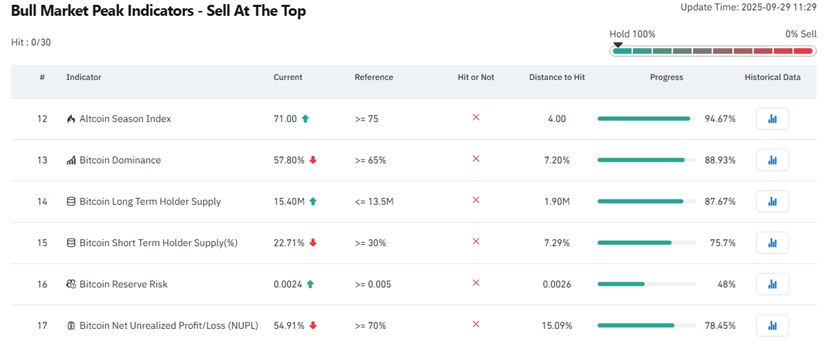

- More than half of Bitcoin’s bull market top indicators have surpassed 50% of their progress, while six exceed 80%.

- Key metrics show BTC dominance reaching nearly 89% and long-term holder supply at 87%; the Crypto Bitcoin Bull Run Index indicates over 83% of its maximum signal.

- Glassnode analysts warn of signs of exhaustion after a brief rally; BTC spot ETFs recorded $900M in net outflows, and the market could face pullbacks.

More than half of Bitcoin’s bull market top indicators have exceeded 50% progress toward sell signals, according to data from the blockchain analytics platform Coinglass.

Of the 30 monitored indicators, six have already surpassed 80%, approaching levels that in previous cycles signaled overheated conditions. Although no indicator has reached 100%, which would trigger a market sell signal, the concentration of signals could surprise the crypto community and spark a new wave of fear (FUD).

Coinglass combines price-based metrics such as the Pi Cycle Top and Golden Ratio Multiplier, on-chain profitability measures like MVRV and Bitcoin net unrealized profit/loss (NUPL), and supply dynamics including long-term holder balances and BTC dominance. For example, Bitcoin dominance has reached nearly 89% of its cycle threshold, while long-term holder supply is at 87% of its critical level. Additionally, the Crypto Bitcoin Bull Run Index stands at 75 out of a maximum of 90, indicating it is over 83% complete.

Bitcoin Market Shows Signs of Exhaustion

Glassnode market analysts point out that Bitcoin is showing “signs of exhaustion” after a brief rally following the September Fed meeting. According to their report, the short-term holder cost basis at $111,000 is a key level: if it fails to hold, the risk of deeper cooling increases. Last week, BTC spot ETFs recorded net outflows exceeding $900 million, the third-largest of the year so far.

The market had already reached a historic high of $124,128 in August, sparking debate over whether the current cycle has already peaked. A recent CoinGecko survey indicates that over half of investors do not expect BTC to surpass $150,000 by year-end, while 13% believe it has already reached its peak for this cycle.

Overall, the indicators show that the Bitcoin market is at critical levels, with signs of overheating and potential pullbacks. However, the lack of a definitive sell signal and the expectation of institutional demand suggest that the cycle could still extend before a broader adjustment occurs