TL;DR

- Minimum balances on exchanges: Long-term holders limit the flow of Bitcoin to the market, reducing liquidity and creating upward pressure on prices.

- Driving factors: Institutional demand, Bitcoin ETFs, and favorable policies such as those proposed by Donald Trump are reinforcing interest in BTC as a strategic asset.

- Impact on market stability: Smaller exchanges face challenges in maintaining liquidity, which could increase volatility during periods of high demand.

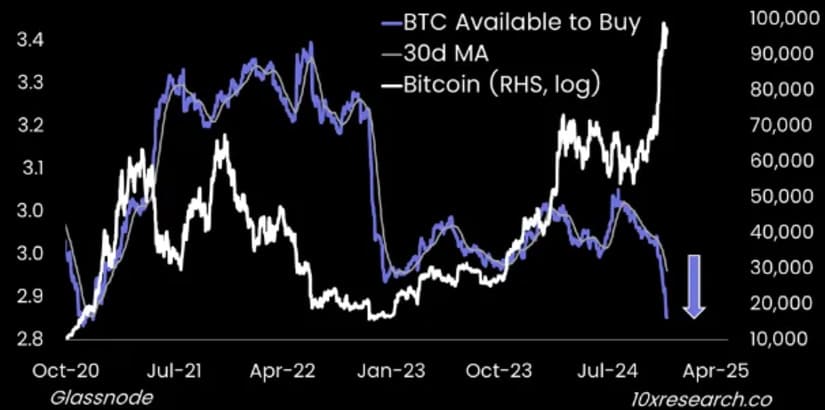

Bitcoin balances on major cryptocurrency exchanges have fallen to historic lows, marking a new phase in the market’s supply and demand dynamics.

Recent on-chain analysis data shows a sustained decrease in the Bitcoin reserves available for purchase, intensifying the supply shortage at a critical moment in its evolution as a financial asset. This phenomenon is largely linked to the behavior of long-term holders, who have opted to keep their assets off exchanges while building a more stable investment base.

The Role of Policy and Bitcoin Institutionalization

The sharp reduction in exchange reserves contrasts with trends observed in previous months when temporary increases in balances helped mitigate market volatility. This time, the scenario is different: the restricted supply shows no signs of immediate recovery, generating upward pressure on the cryptocurrency’s price. During the second half of 2024, Bitcoin experienced a much-anticipated surge in value, coming within striking distance of $100,000. Its rise was driven by a combination of technical, political, and macroeconomic factors.

Institutional interest also plays a fundamental role in this scenario. The consolidation of financial products like Bitcoin ETFs and the increase in institutional adoption have been major drivers of demand, propelling BTC to a more prominent status within traditional investment portfolios. Additionally, expectations around favorable policies for the crypto sector, such as those promised by President-elect Donald Trump in the United States, have revitalized interest in BTC as a store of value and strategic asset.

An Ambitious 2025 for BTC

While major exchanges like Binance, Bitfinex, and Coinbase maintain relatively high liquidity levels, smaller platforms struggle to meet demand, increasing risks of market volatility. This imbalance could have a direct impact on user experience and ecosystem stability, particularly during periods of high trading activity.

The interplay between restricted supply, growing institutional demand, and political-economic interest places the cryptocurrency in a unique position to shape its trajectory in the coming years, with analysts projecting even more ambitious scenarios for 2025