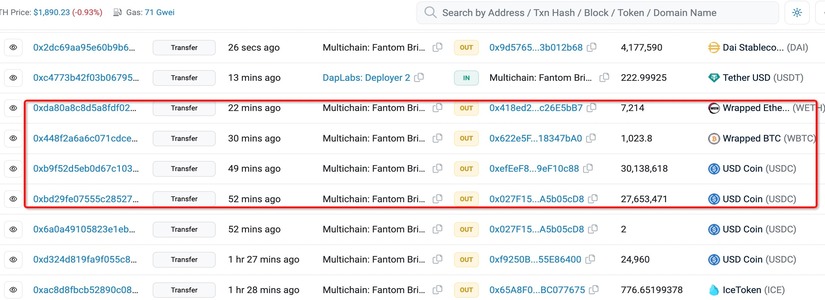

As per the recent development, large outflows from the Multichain MPC bridge have led to speculation that the platform has been exploited. On July 6, several analysts observed that crypto tokens, accounting for almost $102 million, were withdrawn from Multichain’s Fantom bridge on the Ethereum (ETH) network. The withdrawals also included a staggering amount of $666,000 in Dogechain, as well as a whopping $5 million in Moonriver. On the same day, 7214 wETH, 1024 wBTC, and USDC tokens worth $58 million were withdrawn from the Fantom bridge.

Multichain likely hacked. Exit all multichain assets. Good idea to revoke approvals to multichain bridge if you had any

— Curve Finance (@CurveFinance) July 6, 2023

The withdrawal of $666,000 in Dogechain represented a staggering 86% of its total deposits, with only a mere $100,000 in assets being left behind on the chain. However, people considered the activity to be a multi-million-dollar exploit. The blockchain security firm, Peckshield, shared the transaction data and called Multichain out to just have a look. At that time, it remained a mystery whether these contracts were drained by an exploit, or if the funds were simply withdrawn by the users.

It was later confirmed by the network that the assets on the MPC chain were abnormally transferred to an unknown wallet. The platform also mentioned how it was unsure about what really happened and launched an immediate investigation. Multichain also urged its users to stop using its services for the time being and revoke all contract approvals.

The Rocky Journey of Multichain

Multichain is a multi-party computation bridging network. When a user plans to bridge assets from one chain to another, the Multichain network confirms whether or not the assets have been locked on the first chain, and then mints derivatives assets on the second chain.

Whenever a withdrawal is made, the network repeats the process again, but in reverse. It first confirms whether the derivatives coins have been destroyed on the first network, and then releases the assets backing them onto the first chain.

Since the previous few weeks, Multichain has been subject to great technical difficulties. Back in May, the team announced that the firm’s CEO had gone missing, and also mentioned how they had been facing a series of major issues that led to delayed transactions. However, on July 5, Binance halted withdrawals of some Multichain derivatives tokens as a result of the network’s failure to process transactions timely.