TL;DR

- Kraken and Bitget lead the tokenized stock market, valued at $850 million.

- Both platforms restrict U.S. investors due to current regulatory uncertainty.

- Kraken’s market share fell from 97% to 55% as competition grew.

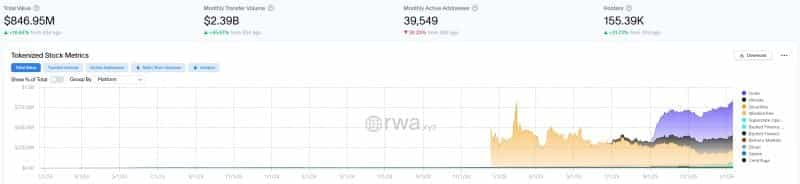

Trading data shows early concentration in the niche of tokenized stocks. Two centralized platforms capture most of the current activity. Kraken, through its xStocks product, and Bitget, in alliance with Ondo Finance, lead this segment. The total value of tokenized public stocks on blockchain stands around $850 million, according to RWA.xyz data.

The monthly trading volume exceeds $2.4 billion. More than 155,000 blockchain addresses hold these assets. Activity picked up in the second half of 2025. However, the offering for U.S. investors remains on hold due to prevailing regulatory uncertainty in the country.

The Battle for Market Share and Different Approaches

Kraken launched xStocks in June of last year through a collaboration with Backed. The platform allows trading tokenized representations of U.S. stocks and ETFs. It offers extended trading hours and fractional exposure. By October, users had traded over $5 billion in xStocks tokenized equities. The platform registered more than $1 billion in onchain transactions and roughly 37,000 unique holders.

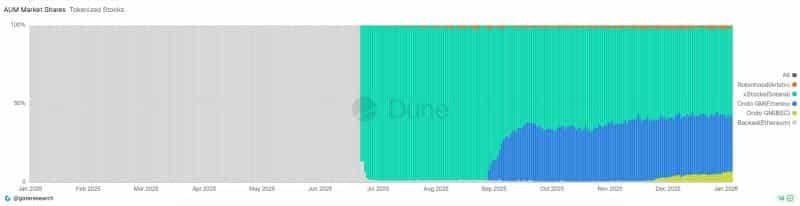

Kraken promotes xStocks as a bridge between traditional equities and the crypto market. The product is not available for clients in the United States. Even so, it consolidated as one of the largest offerings by breadth and activity. Since the start of 2026, Kraken maintained an average of 55% of the tradable tokenized value tracked by Dune. This figure represents a sharp drop from the 97% it held before September.

Bitget adopted a different strategy

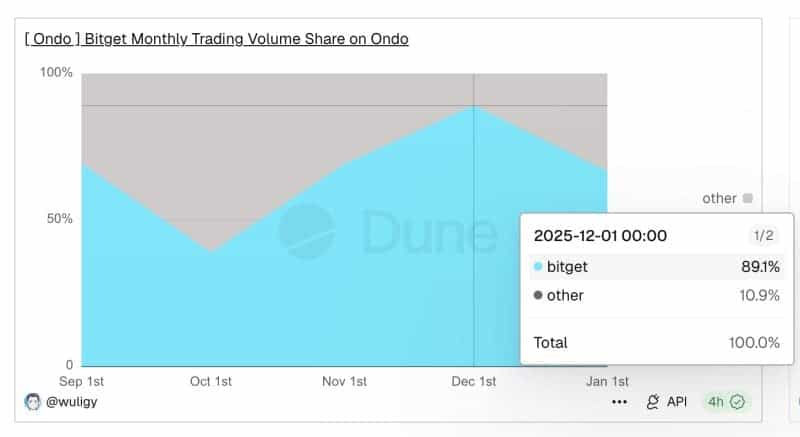

The exchange partnered with Ondo Finance to list tokenized stocks and ETFs issued through Ondo’s Global Markets platform. The cumulative trading volume for tokenized stocks on Bitget approaches $1 billion. In November, Bitget accounted for approximately 89% of the global trading volume for Ondo-issued tokenized stocks. The remaining activity spread across other venues and onchain trading.

These tokens provide exposure to underlying U.S. stocks and ETFs. Their issuance on blockchain infrastructure allows them to move beyond a single exchange environment. Like xStocks, Bitget’s markets are restricted to users outside the United States. Bitget’s rapid expansion of listings and liquidity helped it capture a sizeable portion of early volume.

The Future Hinges on Distribution and U.S. Market Access

The exchange-level picture differs from issuance data. Ondo Finance now represents the largest share of tokenized value issued onchain, surpassing xStokens by total supply. Some tokenized stocks included in those totals, like Exodus shares issued via Securitize, predate the current wave. Those assets trade on regulated platforms, not on cryptocurrency exchanges.

Other major platforms participate marginally or remain in planning mode. Robinhood launched tokenized stock products for EU users in June. Coinbase announced plans to offer tokenized stocks to U.S. users. The company framed the launch as contingent on regulatory compliance. No such product for the U.S. market has launched to date.

The limited footprint of U.S. platforms contrasts with their potential reach. Analysts note that massive distribution could decide future growth. Trading volume for these assets could accelerate if platforms like Robinhood or Coinbase received permission to offer them to their broad user bases.