TL;DR

- Robert Kiyosaki stated that Bitcoin could surpass $1 million before 2030 but emphasized that accumulating BTC is what truly matters.

- The author explained that, just like with gold and silver, he prioritizes accumulating Bitcoin without focusing on its daily price and regretted not buying more when it traded at $6,000.

- Kiyosaki questioned the strength of fiat money and reaffirmed that assets like Bitcoin and precious metals offer effective protection in uncertain monetary scenarios.

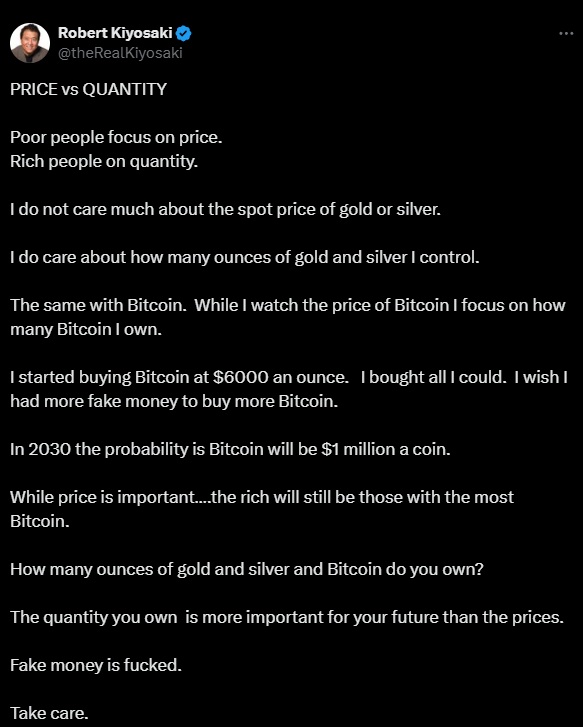

Robert Kiyosaki, author of Rich Dad Poor Dad, once again shared his stance on Bitcoin and cryptocurrencies.

In a post, he claimed that the market’s leading cryptocurrency could reach $1 million per coin before 2030. However, beyond his price prediction, he insisted that what truly matters for any investor is the amount of assets they own, not their spot valuation.

The businessman explained that he has always prioritized accumulating ounces of gold and silver over following their daily prices, applying that same logic to Bitcoin. He clarified that, although he watches market movements, his focus remains on the quantity of BTC he holds. According to him, he began buying when Bitcoin was priced around $6,000 and regretted not having more money at the time to acquire a larger amount.

Kiyosaki Questions the Strength of Fiat Money

In his message, Kiyosaki questioned the stability of fiat currencies, describing them as unstable and lacking real backing. He believes that hard assets like precious metals and Bitcoin offer a more reliable safeguard against the risks tied to currencies issued by central banks.

Earlier this year, Kiyosaki had predicted that Bitcoin could hit $250,000 in the short term and suggested that even a minimal fraction of BTC could hold considerable value in the future. His latest projection, placing BTC above $1 million by the end of the decade, confirms his belief in Bitcoin’s usefulness as a hedge against fiat currency devaluation. At the time of writing, Bitcoin (BTC) trades at around $104,500 per unit.

Additionally, he encouraged his audience to reflect on how much Bitcoin, gold, and silver they currently own, warning that it will be the quantity of those assets — not price swings — that will define their ability to preserve wealth over the long term. Kiyosaki maintains that in a context of growing economic uncertainty, those who accumulate these assets will be better positioned to protect their capital over time