TL;DR

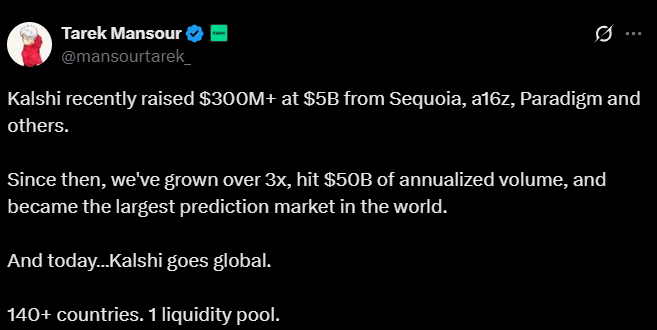

- Kalshi raised $300 million in a Series D round that increased its valuation to $5 billion and will allow it to expand into more than 140 countries.

- The round was led by Sequoia Capital and Andreessen Horowitz, with participation from Paradigm, CapitalG, Coinbase Ventures, General Catalyst, and Spark Capital.

- The platform offers the same experience as in the U.S., but it will remain restricted in 38 jurisdictions.

Kalshi raised $300 million in a Series D round that increased its valuation to $5 billion and will accelerate its expansion into over 140 countries, according to the New York Times.

The round was led by Sequoia Capital and Andreessen Horowitz, with additional participation from Paradigm, CapitalG, Coinbase Ventures, General Catalyst, and Spark Capital. The company is regulated by the CFTC in the United States and aims to build an international network of prediction markets with direct access for global users.

Kalshi to Remain Restricted in 38 Jurisdictions

Kalshi introduced its new infrastructure as a unified system offering the same experience as the U.S. market. However, the company stated that its platform will remain restricted in 38 jurisdictions, including the United Kingdom, France, Canada, Poland, Russia, Singapore, Taiwan, Thailand, and Venezuela. It did not disclose the full list of allowed countries but noted that users can check the details in its membership agreement.

This new capital injection follows a previous round in which the company raised $185 million, led by Paradigm and Sequoia. In June, the firm had been valued at $2 billion. Kalshi has tripled its valuation and increased its projected annualized trading volume to $50 billion, up from $300 million the previous year. The company claims to control more than 60% of the global market, surpassing Polymarket, its main competitor.

The Prediction Market Boom

The growth of this market type reflects the rise in sports betting and institutional interest in event markets as a new asset class. Kalshi has integrated its system with platforms like Robinhood and Webull to facilitate access for retail investors and increase liquidity. Its model combines formal regulation, derivatives infrastructure, and features unique to prediction markets.

Despite CFTC approval, Kalshi has faced lawsuits in several U.S. states accusing it of operating outside betting laws. The company maintains that its system is not gambling but a financial market based on verifiable information