TL;DR

- JPMorgan estimates that Bitcoin could reach $170,000 in six to twelve months.

- The price of Bitcoin falls 1.6% in 24 hours to nearly $101,000.

- JPMorgan calculates Bitcoin’s fair value at $170,000 using gold volatility.

JPMorgan projects Bitcoin could reach $170,000 within six to twelve months as deleveraging in perpetual futures has largely completed and volatility relative to gold has moved to more favorable levels. Bitcoin trades near $101,000, a decline of 1.6 percent over the past 24 hours. Analysts led by Nikolaos Panigirtzoglou cite record liquidations in perpetual futures on October 10 and further liquidations on November 3 after a $128 million exploit at Balancer.

“Overall, we believe that perpetual futures are the most important instruments to watch in the current juncture, and the message from the recent stabilization is that deleveraging in perpetual futures is likely behind us,” the analysts wrote.

The bank reports: the ratio of open interest in bitcoin perpetual futures to market capitalization returned from above-average readings to historical norms within weeks. Similar patterns appear in Ethereum markets, although the effect there is less pronounced. For JPMorgan, perpetual futures serve as the key barometer for current market conditions, while traditional futures and ETF flows show different patterns.

JPMorgan predicting bitcoin at $170k in next 6-12mo, says perp deleveraging is behind us and that's it undervalued vs gold historically, which implies "significant upside next 6-12mo" pic.twitter.com/CaVVWH6L42

— Eric Balchunas (@EricBalchunas) November 6, 2025

Options and futures activity altered price action in October. Exchange-traded products recorded modest outflows recently, while inflows occurred in early October. At the same time, CME futures showed more liquidations in Ethereum than in Bitcoin. Market participants adjusted positions and reduced use of borrowed capital.

Market signals and valuation

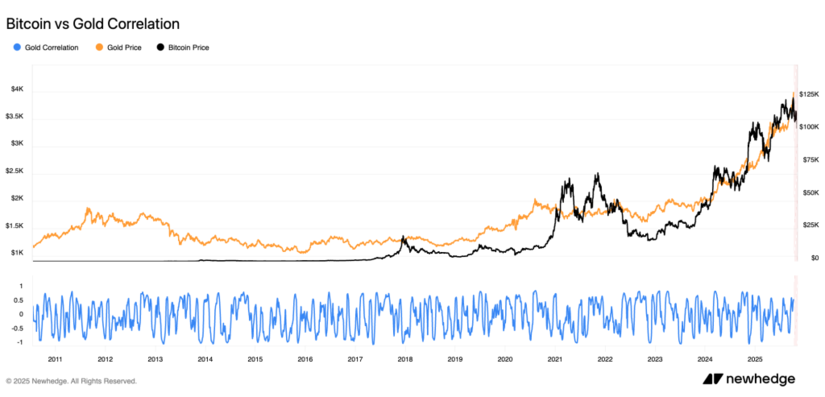

JPMorgan uses a volatility comparison with gold to calculate a volatility-adjusted fair value for Bitcoin. The bitcoin-to-gold volatility ratio sits near 1.8, indicating Bitcoin consumes about 1.8 times more risk capital than gold. Based on private-sector investment in gold through ETFs and physical holdings, the bank estimates a theoretical market value for Bitcoin near $170,000. The calculation implies a required market-cap rise of roughly 67 percent from current levels.

Investors show varied responses. Some prefer exchange-traded products as a familiar route to gain exposure, while others allocate across digital-native platforms. Analysts note selling pressure from perpetual liquidation events eased: deleveraging may be over. Meanwhile, rising gold volatility improves Bitcoin’s relative appeal on a risk-adjusted basis.

Risk remains. Price swings can reverse quickly and a sudden shock could trigger fresh liquidations. Successful allocation requires measured steps and careful control of borrowed capital. Many professional managers advise staged entries and clear exit rules to limit downside. Trading desks expect volatility to remain a central factor in coming months. Measured monitoring continues.