TL;DR

- Solana lost 93% of its revenue since its peak in January due to the drop in trading volume and the collapse of memecoins.

- The activity of trading bots, which once accounted for 86% of transactions, has drastically decreased, further weakening the ecosystem.

- Solana’s TVL fell from $11 billion to $6.96 billion, reflecting a loss of confidence and an outflow of capital to other blockchains like BNB Chain and Ethereum.

Solana positioned itself as one of the most promising blockchains during the last crypto bull market. Its ability to handle thousands of transactions per second and its low fees made it a strong competitor against Ethereum and BNB Chain.

However, Solana’s explosive growth was not driven solely by its underlying technology but also by a speculative frenzy fueled by memecoins and projects of questionable legitimacy. Today, with a 93% drop in revenue since its peak in January, the question arises: Is Solana dying, or is it just a necessary correction?

The Weight of Memecoins and Rug Pulls

Solana’s ecosystem quickly became fertile ground for launching memecoins, some enjoying brief success and others embroiled in scandalous rug pulls. The emergence of projects like TRUMP, MELANIA, and LIBRA was inevitably accompanied by heavy speculation and euphoria, attracting both retail investors and trading bots. However, after the collapse of these projects and the significant losses suffered by traders, the enthusiasm faded.

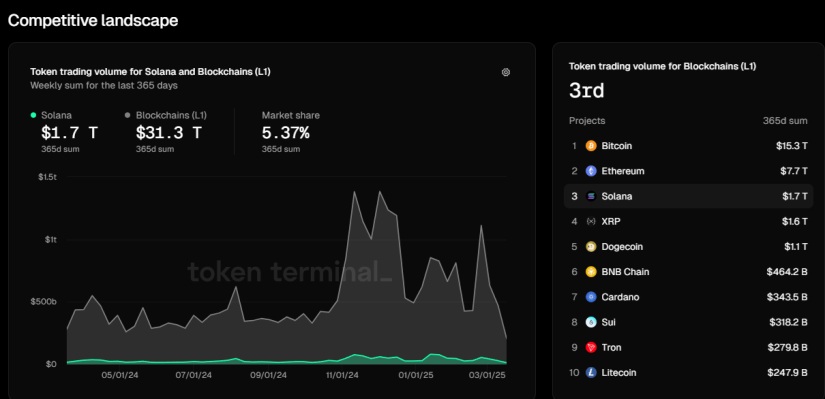

The result was a sharp decline in trading volume and revenue generated by Solana’s decentralized applications (dApps), such as Pump.fun, JitoSOL, and JupiterDEX. According to TokenTerminal, Solana’s weekly token trading volume fell from $80 billion in January to just $28 billion in March. The decrease in trading bot activity, which once accounted for up to 86% of transactions at its peak, further weakened the ecosystem.

User Exodus and Decline in Confidence

Beyond opportunistic traders and bots, Solana’s retail user base began to shrink. Most active wallets hold less than 1 SOL, while only about 4,971 wallets hold more than 10,000 SOL. This pattern indicates limited genuine activity and long-term interest, leaving the network vulnerable to speculative swings.

Solana’s Total Value Locked (TVL), which reached $11 billion in January, fell to $6.96 billion, reflecting the outflow of capital and loss of confidence in its ecosystem. Although liquidity in stablecoins, particularly in USDC, remains substantial, interest in creating new DeFi protocols and products appears to have cooled.

A Foreseen Death or a Chance to Show Resilience?

It can be argued that Solana is undergoing a purge process, where weaker and purely speculative projects are dissolving, allowing stronger initiatives to gain ground. However, the decline in revenue and the migration of activity to other chains like BNB Chain, Base, and Ethereum are concerning signs. Blockchains that survive crises usually adapt, innovate, and strengthen their fundamentals, but Solana’s ability to do so is still in question.

The notion that SOL only serves to run memecoins and facilitate low-quality exchanges is dangerous for its long-term development. If the network fails to attract more impactful projects with real utility, its future could be closer to collapse than to sustainable recovery.

Conclusion: Solana at a Crossroads

The decline in revenue and the exodus of users and trading bots expose the fragility of an ecosystem that grew rapidly but whose foundation appears to have been built on speculation and inflated expectations. Solana still has the technical potential to reinvent itself and establish itself as a relevant blockchain, but to do so, it must overcome the perception of being a temporary refuge for projects of questionable quality. If it fails to redefine itself and attract developers and genuine capital, its future could be marked more by decline than by a new phase of growth