Dubai is ramping up its efforts to become the new crypto capital of the world as the biggest names in the industry have set up shops in the city. As more and more countries around the world are embracing cryptocurrencies, Dubai, has turned on the heat to the next level. Is Dubai ready to become the next big thing in cryptoverse?

Dubai’s Crypto Journey with VARA

In February, 2022, the Emirate of Dubai enacted Law No. 4 of 2022 on the Regulation of Virtual Assets (VAL) and established the Dubai Virtual Assets Regulatory Authority (VARA). With this move, Dubai’s vision to create one of the most sought after ecosystems for entrepreneurs and investors of the emerging Web3 technology, spawned.

According to the government of United Arab Emirates (UAE), VARA will act as an independent authority under the Dubai World Trade Centre Authority, which will oversee the regulation, governance, and licensing of cryptocurrencies, NFTs, and other virtual assets. Sheikh Mohammed bin Rashid Al Maktoum, prime minister of the UAE, wrote,

“Today, we approved the virtual assets law and established the Dubai Virtual Assets Regulatory Authority. A step that establishes the UAE’s position in this sector. The Authority will cooperate with all related entities to ensure maximum transparency and security for investors.”

Today, we approved the virtual assets law and established the Dubai Virtual Assets Regulatory Authority. A step that establishes the UAE’s position in this sector. The Authority will cooperate with all related entities to ensure maximum transparency and security for investors. pic.twitter.com/LuNtuIW8FM

— HH Sheikh Mohammed (@HHShkMohd) March 9, 2022

VARA seeks to regulate the issuance of new crypto tokens, supervising and controlling the trading of virtual assets, ensuring that high standards of protection are in place, monitoring transactions, and more. In addition, the transfer of virtual assets, management services, exchange services, operating virtual assets platforms and virtual asset custody will also be under VARA’s domain.

The law also prohibits anyone from engaging in crypto-related activities without VARA’s authorization. People who wish to deal in digital assets will have to establish a presence in Dubai.

Hosts of Crypto Companies Move to Dubai

#Binance has been granted a Virtual Asset License from Dubai’s Virtual Asset Regulatory Authority (VARA).

This licence ensures that #Binance will be able to operate its regional business from Dubai, UAE 🇦🇪https://t.co/bqeMe1T54z

— Binance (@binance) March 16, 2022

After adopting the law, Dubai, has been continuously gaining ground with the crypto community. Bigwigs of the crypto industry including Binance and FTX were recently awarded virtual asset licenses. In December last year, the Dubai Media Office said that the Dubai World Trade Centre would officially become a crypto zone, from where all companies operating cryptocurrencies and virtual assets can operate.

In March, cryptocurrency exchange, Bybit, shifted its headquarters from Singapore to Dubai. On the same day, another Singapore based crypto exchange, Crypto.com secured a provisional approval to open a cryptocurrency exchange in Dubai. In a statement, Crypto.com co-founder, Kris Marszalek, said,

“We are excited to provide more of our products and services in a market of great importance to our business, and one that is equally committed to regulation and compliance.”

Why is the Gulf City booming into a Crypto Hub?

Amrit Dhami, Thematic Analyst at GlobalData, a leading data and analytics company, said that the UAE’s regulation is more about overseeing the development of the crypto sector than curbing it. By accepting the inevitability of mainstream cryptoassets and helping the domestic crypto sector grow, the UAE will continue to attract a flock of crypto firms. She explained,

“The adoption of crypto on a local level is noticeable in the UAE. For example, grocery delivery service YallaMarket is accepting payments in crypto and has floated the idea of paying salaries in crypto. The government’s regulatory stamp of approval on virtual assets is likely to have helped drive this acceptance. Not only is there popular demand for crypto services, but there’s also a pool of enthusiastic, crypto-aware local talent for recruiters to tap into.”

Ralf Glabischnig, founder and board member of Swiss crypto hub CV Labs, said that the market in Dubai will “grow faster compared to anywhere else”, and attributed the current interest from investors and entrepreneurs to the emirate’s business environment. He remarked,

“The most important thing when you create a new industry is talent. A lot of smart people came to Dubai and stayed here.”

At a conference, Dr. Marwan Al Zahrouni, chief executive of the Dubai Blockchain Centre, revealed that free zones in Dubai have implemented an advanced framework to encourage entrepreneurs in the crypto space to set up exchanges while laying out rules to protect consumers. Zahrouni said,

“Five years ago you wouldn’t see people coming to Dubai to do the cryptocurrency business … we’re open-minded, and we’re willing to change regulations with reason.”

More Companies Follow Suit

On Thursday, accounting behemoth, PwC’s crypto head, Henri Arslanian, quit the firm to set up a $75 million digital asset fund in Dubai. According to reports, Arslanian’s new fund, Nine Blocks Capital Management, has been granted provisional regulatory approval in Dubai. The ex-PwC head said that, Dubai was the best option for his new fund citing several reasons including the absence of a “Tier-One” licensing regime and regulatory hurdles.

We’re pleased to announce that CoinMENA has obtained a provisional license from Dubai’s VARA, making it the third license we would obtain after securing two digital assets licenses in just over a year since our launch.

🔗 https://t.co/7HeWOKT6WW#Cryptocurrency #Regulation #Dubai pic.twitter.com/lXX0Dk9Lrz— CoinMENA | كوين مينا (@CoinMENA) June 16, 2022

Last month, CoinMENA, a Sharia-compliant digital asset exchange company licensed by Bahrain’s central bank, has obtained a provisional virtual assets licence from Dubai’s VARA. With Europe and the US, comparing the digital asset class to the “Wild West”, the script for Dubai is quickly flipping. In the last few months, the UAE has handed out more than 30 licences and passed new laws for crypto exchanges to operate in the cities of Dubai and Abu Dhabi.

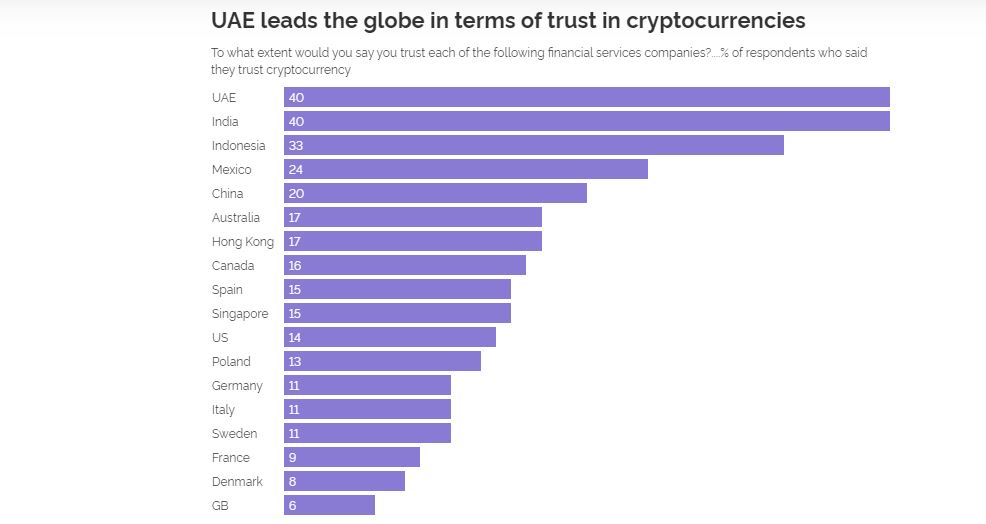

Local businesses like grocery delivery service, YallaMarket and property firms including DAMAC Properties and Emaar are accepting payments in crypto. A global YouGov survey found that trust in cryptocurrencies was highest among adults in the UAE. Emma McInnes, Global Sector Head of Financial Services at YouGov, specified,

“Building trust among consumers is pivotal for this emerging asset class to accelerate adoption. Countries like the UAE have already created governing bodies to measure and promote the growth of virtual assets, and by doing so, it’s keeping itself ahead of most of the world in terms of developing the crypto market.”