TLDR:

- XRP is in a compression zone within a descending channel on the 5-day chart.

- Analysts identify a controlled correction that typically precedes aggressive expansion phases.

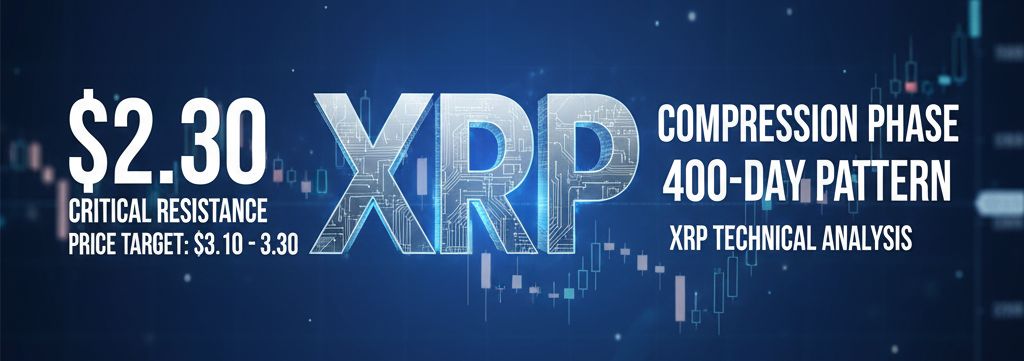

- The $2.30 level is established as the definitive resistance to confirm a trend shift.

The recent behavior of Ripple is keeping the cryptocurrency market on edge, as XRP technical analysis shows alignment signals across multiple timeframes. In this regard, analyst EGRAG stated that the asset has entered a relevant technical phase, characterized by a compression structure that has historically served as a prelude to explosive price movements.

Currently, XRP is trading within a clean descending channel. This is not a sign of weakness or mass distribution; experts suggest that this structure reflects a controlled correction following the previous strong bullish momentum. The price is accurately respecting the channel boundaries, indicating that the market is “cooling off” its momentum before the next major move.

Key Levels to Confirm the XRP Breakout

For the asset to validate a structural change toward a bullish scenario, three conditions must be met. First, the asset needs a sustained close above the 21-period Exponential Moving Average (21 EMA). Second, a successful retest that turns this level into solid support is vital. Finally, the definitive signal would be a decisive breakout above the $2.30 barrier.

If the price surpasses $2.30, the market structure would change drastically. Projections based on previous resistance clusters foresee that the next technical target would sit in the $3.10 to $3.30 range.

In summary, despite the uncertainty, structural probabilities favor an upside resolution. Descending channel patterns usually resolve with an upward expansion once buying pressure overcomes supply at the edge of the vertex. For now, investors remain attentive to daily closes, seeking confirmation that this cycle will emulate the historic growth seen in previous years.