TL;DR

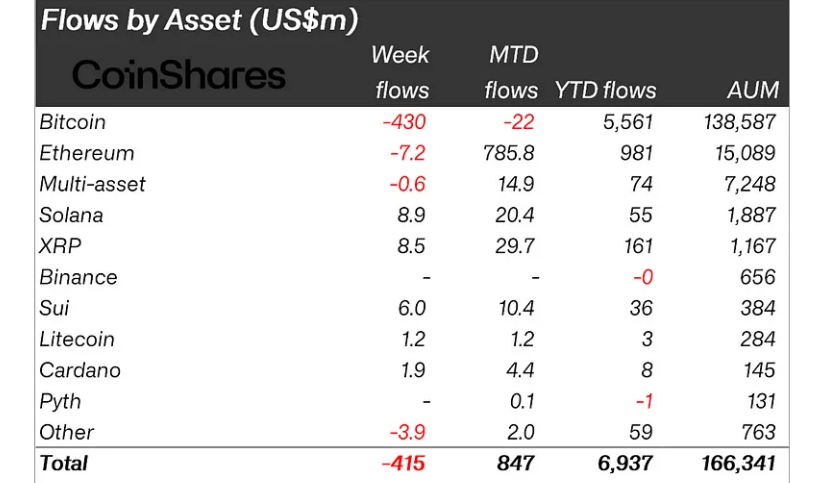

- After 19 consecutive weeks of capital inflows into digital asset products, the industry experienced a significant outflow of $415 million.

- The primary cause of these outflows was a more hawkish stance from the U.S. Federal Reserve and inflation data that exceeded expectations.

- Despite outflows in the U.S., countries like Germany, Switzerland, and Canada saw capital inflows into their crypto products.

The digital asset market has experienced an unexpected shift. After an unprecedented 19-week streak of consecutive capital inflows totaling $29.4 billion since the U.S. elections, investment flows in cryptocurrencies were abruptly interrupted. This first major outflow in nearly five months resulted in $415 million leaving the market. The disruption occurred amid economic uncertainty, triggered by a speech from Jerome Powell, Chairman of the Federal Reserve (Fed), in which he adopted a more aggressive monetary stance. Additionally, U.S. inflation data exceeded expectations, sparking concern among investors.

Bitcoin Takes the Brunt: The Response of Investors

Bitcoin, the cryptocurrency most sensitive to changes in interest rate expectations, bore the brunt of the outflows, with $430 million in negative flows. However, what’s particularly intriguing is that, despite this massive outflow of funds, there was no significant uptick in short-Bitcoin products. In fact, these products saw outflows of $9.6 million. This suggests that investors are not fully convinced about a long-term downturn in Bitcoin’s price, but rather reacting to short-term market fluctuations. The market sentiment around Bitcoin remains volatile, reflecting the broader economic uncertainties.

Solana, XRP, and Sui: The Assets Gaining Investor Interest

While Bitcoin suffered substantial capital outflows, other cryptocurrencies such as Solana (SOL), XRP, and Sui (SUI) saw positive inflows. Solana emerged as the leader with the highest capital inflow, totaling $8.9 million, followed closely by XRP and Sui with inflows of $8.5 million and $6 million, respectively. This behavior indicates that investors continue to seek diversification within the crypto market, opting for assets that offer potentially higher short-term returns. The preference for these assets suggests that investors are strategically positioning themselves to capitalize on potential growth outside of Bitcoin.

The Market Continues to Adapt to an Uncertain Landscape

While the recent drop in cryptocurrency investment flows might appear concerning, it is crucial to recognize that the industry remains resilient. Digital assets continue to attract interest, particularly from countries like Germany, Switzerland, and Canada, which recorded inflows of $21 million, $12.5 million, and $10.2 million, respectively. Moreover, blockchain-related equities also showed positive behavior, with inflows of $20.8 million. Despite the temporary downturn, the interest in the crypto ecosystem remains strong, with the industry adapting to new economic realities.