TL;DR

- Global investment firm Millennium Management reveals its participation in Bitcoin ETFs in the first quarter of 2024.

- The firm holds around $1.9 billion in BTC ETFs, distributed across various products from different issuers.

- More than 563 companies report a combined investment of $3.5 billion.

Millennium Management, a global investment firm with over $60 billion in assets under management, has revealed its participation in Bitcoin exchange-traded funds (ETFs) during the first quarter of 2024. The data was outlined in a recent 13F report filed with the Securities and Exchange Commission (SEC).

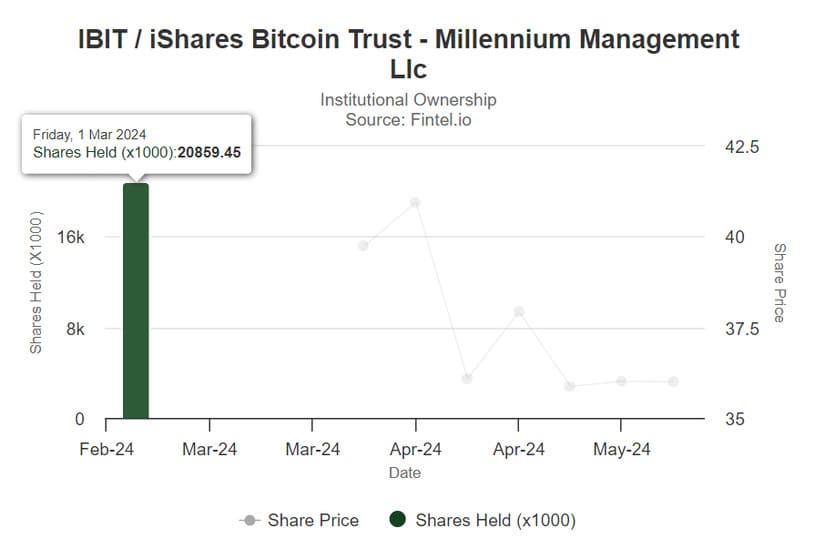

According to the report, Millennium holds approximately $1.9 billion in a variety of Bitcoin ETFs traded in the United States. Its largest holdings include BlackRock’s iShares Bitcoin Trust (IBIT), Fidelity’s Wise Origin Bitcoin Fund (FBTC), and the Grayscale Bitcoin Trust ETF (GBTC). Additionally, the firm has smaller investments in the ARK 21Shares Bitcoin ETF (ARKB) and the Bitwise Bitcoin ETF (BITB), demonstrating good diversification in its portfolio.

Millennium joins the trend. Other significant asset managers are also increasing their stakes in BTC ETFs. Pine Ridge, for example, has reported an investment of $205 million in IBIT, FBTC, and BITB. Similarly, Schonfeld Strategic Advisors has made an investment of $248 million in IBIT and $231.8 million in FBTC, totaling $479 million.

According to Matt Hougan, Chief Investment Officer at Bitwise, there has been significant growth in the number of professional investment firms holding BTC ETFs. More than 563 companies report a combined investment of $3.5 billion in the latest report. It is expected that this number will surpass 700 companies, approaching a total of $5 billion in assets under management.

Millennium Boosts Institutional Investment in Bitcoin

Hougan compared the interest in Bitcoin ETFs to the successful launch of gold ETFs in 2004, which attracted over $1 billion in their first five days of trading. The rapid growth in interest in BTC ETFs marks a shift in the perception of cryptocurrencies by institutional investors.

Although most investments in ETFs currently come from retail investors, Hougan suggests that there will be a shift in this trend, resulting in greater institutional participation in the near future. He used Hightower Advisors as an example, a firm that has allocated $68 million to BTC ETFs, representing only a minimal fraction of its total assets. However, such allocations will increase over time, potentially becoming a significant portion of institutional portfolios.

Millennium Management’s investment in BTC represents a significant advancement in institutional adoption of the crypto market. There is growing confidence in the long-term potential of digital assets, paving the way for greater adoption in the conventional financial realm.