TL;DR

- Over the past five weeks, digital asset investment products have recorded $6.4 billion in fund outflows, marking the worst losing streak since 2015.

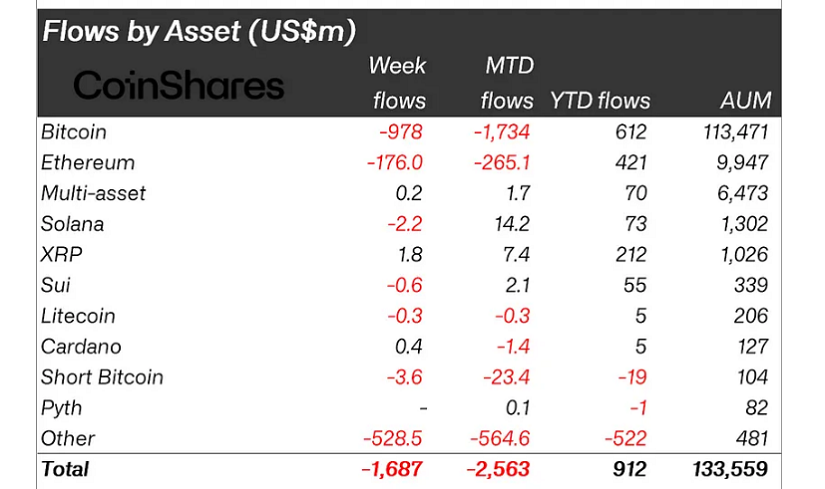

- Bitcoin suffered a capital outflow of $978 million last week, while XRP continued to attract investment with a net inflow of $1.8 million.

- Despite the market correction, net inflows for the year remain positive at $912 million, reflecting underlying confidence in digital assets.

The cryptocurrency investment ecosystem has been experiencing a historic negative streak, with five consecutive weeks of massive institutional withdrawals. In the past week alone, digital asset investment products saw a capital outflow of $1.7 billion, bringing the total withdrawals to $6.4 billion during this period. This wave of outflows has led to a $48 billion decline in assets under management (AuM), marking a significant setback for the sector.

Despite the selling pressure, the data indicates that the industry is holding strong. Throughout 2025, crypto investments have recorded net inflows of $912 million, suggesting that while there is a short-term adjustment, long-term investor confidence remains intact.

Bitcoin Under Pressure, But XRP Shows Strength

Bitcoin, the market leader, has been the most affected by this bearish cycle, with a capital outflow of $978 million in the past week alone, bringing the five-week total to $5.4 billion. However, such corrections have occurred before in Bitcoin’s history, and they have often preceded strong recoveries. Many seasoned investors view these dips as opportunities to accumulate assets at lower prices, anticipating a future rebound.

Ethereum and Solana have also been caught in the negative trend, with outflows of $175 million and $2.2 million, respectively. However, not all cryptocurrencies are in decline: XRP has remained an attractive asset, recording $1.8 million in inflows. This suggests that investors still see value in its technological proposition and its potential role in the global financial system. Such inflows indicate confidence in the asset’s future utility despite overall market uncertainty.

Outlook: Is This a Crisis or an Opportunity in Disguise?

While the short-term outlook appears challenging, downturns in the crypto market are nothing new. Historically, these phases have served as consolidation periods before new bullish cycles. Furthermore, with institutional interest still present and a rapidly evolving market, analysts believe that these movements could represent strategic opportunities for long-term investors looking beyond momentary fluctuations.

The crypto market has repeatedly demonstrated its ability to bounce back. With the increasing adoption of blockchain technology and a constantly evolving ecosystem, this correction may just be a pause before the next major wave of growth.