TL;DR

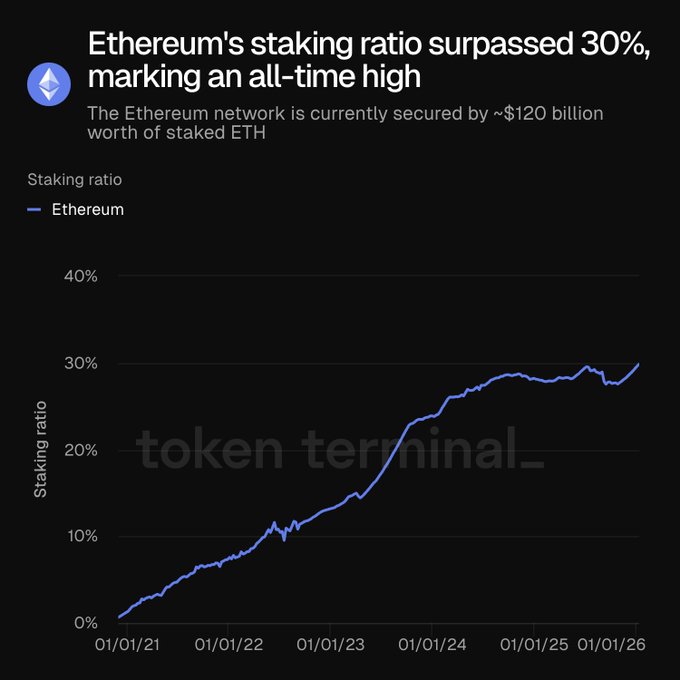

- Ethereum staking reached a record 36.2 million ETH, equivalent to 30% of the total supply and valued at approximately $115,000 million.

- The validator entry queue stands at around 2.7 million ETH, the highest level since 2023, while the exit queue remains near zero.

- Ethereum fell 6.5% over the past 24 hours, is trading just above $3,000, and posts daily volume of roughly $26,000 million, down 8%.

Ethereum staking hit an all-time high, pushing the volume of ETH locked on the Beacon Chain to new levels. Data from Token Terminal and Ultrasound Money shows that total staked ETH reached 36.2 million, with an estimated value of $115,000 million. That figure represents close to 30% of the asset’s total supply, which remains locked to secure the network and earn annual yields of around 2.8%.

The rise in staking coincided with a sustained increase in the validator entry queue. Currently, about 2.7 million ETH are waiting to be staked, marking the highest level since 2023. At the same time, the exit queue dropped to near-zero levels, according to Validator Queue data, indicating a complete absence of withdrawal requests in the short term.

The Growth of Institutional Participation

A significant share of the ETH waiting to be staked belongs to institutional players. These include digital asset treasuries and regulated vehicles such as ETFs, which now have structures in place to offer staking rewards. Their participation lifted the total amount of ETH staked and expanded the presence of institutional capital within Ethereum’s validation mechanism.

Congestion in Ethereum’s Staking Queue

From within the ecosystem, Ethereum’s official X account stated that institutional adoption has accelerated over recent months and cited more than 35 recent cases of institutions building products and services on the network. That information was amplified by analysts from both traditional finance and the crypto sector, including figures from financial firms with direct exposure to ETH.

The increase in staking reduced the amount of ETH available on exchanges and in active circulation. As more units are locked in validation contracts, liquid supply contracts and becomes concentrated among a smaller subset of addresses with immediate transfer capacity.

At the same time, several analysts noted that staking metrics reflect coin volume rather than the number of participants. A single large holder can account for a substantial share of total staked ETH, creating meaningful differences in terms of concentration and effective liquidity.

In the spot market, Ethereum posted a 6.5% decline over the past 24 hours. The asset is now trading just above $3,000. Trading volume fell 8% and stands at just over $26,000 million