TL;DR

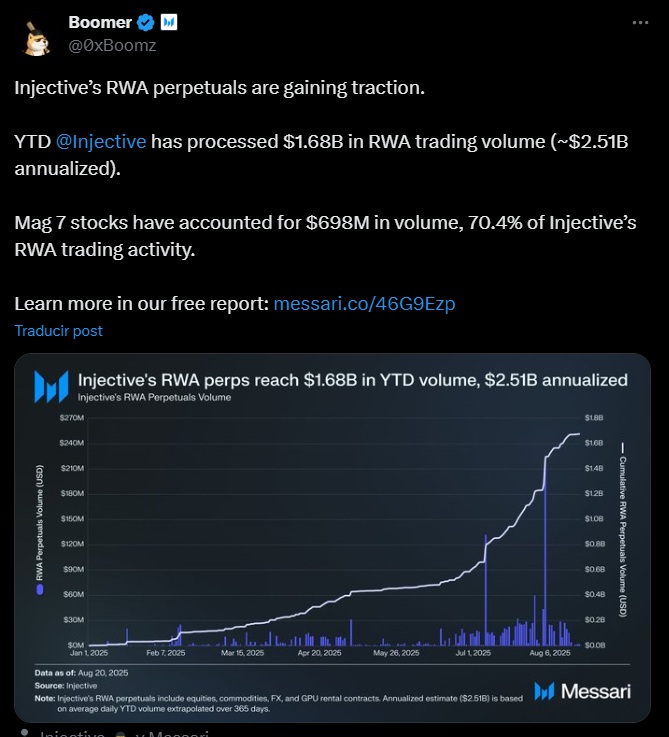

- Injective processed $1.68 billion in perpetual contracts and projects $2.51 billion in 2025, with equities driving growth.

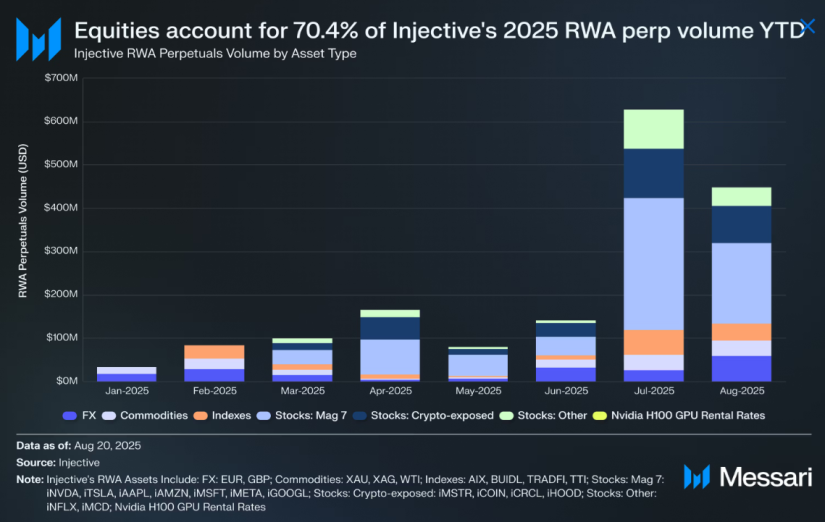

- Contracts tied to the Magnificent 7 lead the equity segment, while Coinbase and Strategy together surpassed $250 million.

- The platform includes indexes, forex, commodities, and a derivative on Nvidia H100 GPUs.

Injective solidified its role in 2025 as one of the most active platforms for trading real-world assets in decentralized environments.

From January through August 20, its perpetual contracts reached a cumulative volume of $1.68 billion, projecting annual activity near $2.51 billion. Growth accelerated in July with the influx of tech stocks, which quickly dominated trading.

The equities segment accounts for more than 70% of total volume. Contracts linked to the so-called Magnificent 7 captured most of the activity, led by Nvidia, Tesla, and Alphabet, each surpassing $100 million in trades. Apple, Amazon, Microsoft, and Meta also recorded significant figures.

Equities tied to the crypto market also drew strong investor interest. Coinbase and Strategy together exceeded $250 million, while Robinhood and Circle contributed nearly $58 million. Traders use Injective’s infrastructure to gain continuous access to assets that in traditional markets trade only during limited hours.

Indexes also gained traction as an option for investors. The TradFi Tech Stock Index generated nearly $97 million and the TradFi Stocks Index exceeded $58 million. They were joined by the Helix AI Index, which combines tokens and equities related to artificial intelligence, posting more modest volumes but with growth potential. In parallel, the perpetual contract tied to BlackRock’s tokenized BUIDL fund recorded marginal activity in 2025.

Injective Shows the Potential of Decentralized Markets

The forex market ranked second in activity with nearly $400 million. The euro and British pound pairs against USDT offer up to 100x leverage in a fully onchain system. Commodities also carved out a role, totaling $146 million, led by gold, followed by silver and crude oil.

In August, Injective introduced a perpetual contract linked to Nvidia H100 GPU rental costs. This instrument opens the door to creating derivatives on digital infrastructure and emerging markets tied to artificial intelligence. While volumes remain low, it illustrates the potential of the iAssets framework to bring unconventional assets onchain.

Injective’s goal is to replicate traditional financial structures on an open and efficient network. The iAssets design removes the need for overcollateralization and relies on liquidity providers who adjust capital dynamically. This model enables trading of equities, indexes, forex, and commodities in a programmatic, always-available environment, showing that decentralized markets can handle multibillion-dollar volumes with their own mechanisms