TL;DR

- 21Shares has filed for an Injective (INJ) ETF, aiming to capture growing institutional interest in the project.

- The ETF would allow exposure to INJ without managing wallets or private keys, keeping tokens in cold storage and tracking their market price in real time.

- If approved, the ETF would expand institutional adoption and increase Injective’s visibility.

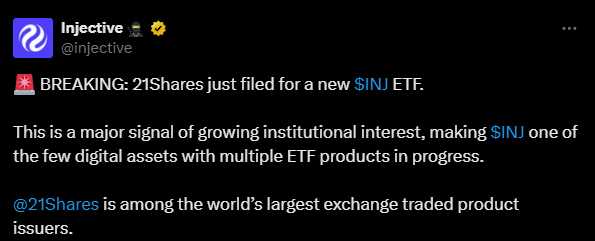

21Shares has filed for an ETF focused on Injective (INJ), bringing this DeFi project closer to traditional investors. The proposal makes INJ one of the few digital assets with multiple ETFs in development, showing clear institutional demand for the token.

The ETF would let investors gain exposure to INJ without handling wallets or private keys. Tokens would be held in cold storage while users could monitor market prices in real time. The structure mirrors Bitcoin and Ethereum spot ETFs, integrating INJ into traditional financial frameworks in a practical and secure way.

Injective is a high-performance blockchain built for DeFi applications. Its network processes over 25,000 transactions per second, and its native token, INJ, secures the chain through a delegated proof-of-stake system. Its infrastructure combines exchange functionalities with Comet BFT consensus, solving issues of fragmented liquidity and slow transaction finality. This design enables developers to build fast, scalable DeFi applications on the network.

Injective as a Bridge Between DeFi and Traditional Markets

This month has been pivotal for crypto ETFs. The SEC has reviewed several filings, including those for XRP, Solana, Cardano, Litecoin, and HBAR. New regulatory guidelines have shortened approval timelines from roughly nine months to under three, accelerating what analysts describe as the second wave of ETFs centered on altcoins.

If approved, the Injective ETF would be key to strengthening the bridge between decentralized protocols and traditional financial markets, driving institutional participation in DeFi and increasing Injective’s market presence. It would also provide a practical tool for traditional investors to follow the performance of a DeFi protocol without directly managing tokens.

Financial institutions are increasingly recognizing the relevance of advanced blockchains. Digital assets can be integrated seamlessly into familiar instruments such as ETFs. The filing is currently under regulatory review, and both the market and the community are watching closely to assess the potential impact of an INJ ETF on network adoption and token liquidity