TL;DR

- Infini, a widely used crypto card provider among Chinese users, has announced the complete shutdown of its card services, citing high regulatory costs.

- Despite the closure, core features such as withdrawals and yield products remain fully operational.

- The company is shifting its focus toward decentralized solutions and digital asset management as it works to stay relevant within increasingly restrictive legal frameworks.

Infini, the Hong Kong-based fintech that for years enabled users to spend stablecoins like USDT and USDC through Visa and Mastercard networks, confirmed this week the official discontinuation of its Global, Lite, and Tech card offerings. The move impacts thousands of users, particularly in mainland China, where access to Infini was mostly made possible through VPNs as a workaround to national bans on foreign crypto platforms.

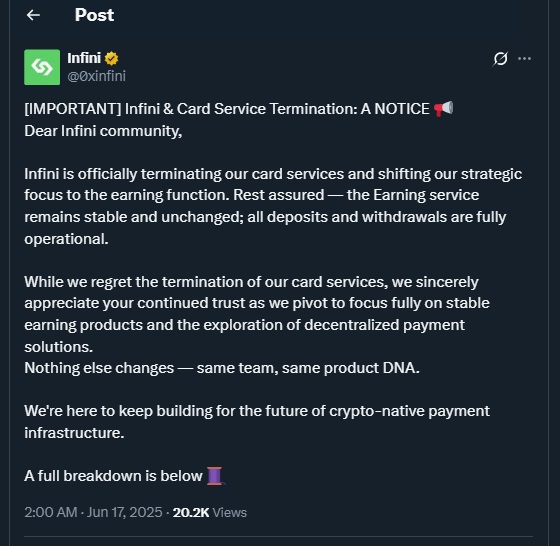

Mounting compliance costs and shrinking profitability forced the company to halt its card services indefinitely. In a public announcement, Infini clarified that all non-card functions, including its “Earn” yield system and crypto withdrawals, will remain unaffected. Users who paid for a card but never activated it will be refunded automatically, with processing times of up to 21 days depending on the receiving bank.

Shift Toward Asset Management And Decentralized Payments

Rather than exiting the crypto space entirely, Infini is pivoting toward more sustainable services. Founder Christian Li stated that the company is actively developing new features centered on decentralized payment solutions and stable-yield financial products. This strategic realignment aims to reduce exposure to local regulatory constraints while enhancing the robustness of crypto payment infrastructure.

The shift did not emerge in isolation. In February, Infini suffered a $50 million exploit attributed to a former developer who retained administrative control post-deployment. Despite the loss, the platform never froze withdrawals and committed to full user compensation. That decision played a key role in preserving user trust.

The end of its crypto card program marks the closure of one chapter, not the end of the story. In a market increasingly shaped by legal hurdles, Infini is choosing to move forward by building tools that better reflect the decentralized ethos of digital finance. Rather than fading away, the company is aiming to reinvent itself as a more focused and adaptable player.

This forced adaptation could, in time, become a blueprint for other crypto startups facing similar challenges across Asia and beyond. As Infini looks to the future, it’s doubling down on building for sustainability, autonomy, and alignment with the foundational values that first defined the crypto space. The closure of its card services may be seen, in hindsight, as the necessary reset for a more resilient phase of growth.