TL;DR

- A Hyperliquid trader turned $125,000 into nearly $30 million in four months using leveraged Ethereum trades.

- The ETH rally, fueled by $900 million in institutional purchases and projections of up to $7,500, created a favorable environment for high-risk, high-reward strategies.

- An original 2014 ICO wallet turned a $104 ETH purchase into $1.5 million after more than a decade of holding.

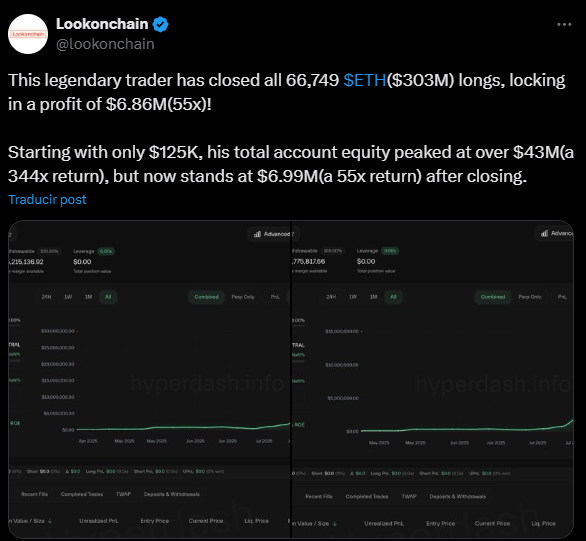

A trader on Hyperliquid managed to convert $125,000 into almost $30 million over four months through leveraged Ethereum trades.

Hyperliquid allows users to trade with leverage on its own Layer-1 blockchain, with ETH as the primary asset in these operations. The trader started with a modest investment, splitting funds across two accounts while Ethereum was trading below $2,000.

How Was It Possible?

As ETH surpassed $4,000, the trader reinvested profits into larger and increasingly leveraged positions, reaching a maximum exposure equivalent to 66,749 ETH, with a theoretical value above $300 million. Although the account equity peaked at $43 million, closing the positions secured $6.9 million, representing a real return of 55 times the initial investment.

The gains were fueled by Ethereum’s sustained rally, which has shown steady momentum in recent weeks. Analysts at Standard Chartered project ETH could reach $7,500 by year-end, while many traders consider $5,000 the next significant psychological level.

Institutional activity also increased, with funds acquiring roughly $900 million in ETH, adding buying pressure and liquidity to the market. These factors created a favorable environment for high-risk, high-return strategies like those executed by the Hyperliquid trader.

Traders and Holders Can All Profit from Ethereum

On the other hand, an original Ethereum ICO wallet from 2014 turned a $104 ETH purchase into about $1.5 million after more than a decade of holding. This shows that patience can be as profitable as bold leveraged trading. The example illustrates how the ETH ecosystem allows wealth generation both for aggressive traders and long-term holders.

Trading with leverage can multiply gains, but it also carries the risk of rapid and significant losses. Even so, cases like this confirm that Ethereum continues to provide extraordinary profit opportunities, enabling both experienced traders and long-term holders to achieve returns capable of transforming their financial position