TL;DR

- HyperLiquid faces a critical situation after recording a record $60 million outflow in USDC, sparking speculation about possible attacks by North Korean hackers.

- Analysts point out that addresses linked to North Korea might be testing vulnerabilities, incurring losses exceeding $700,000 on the platform.

- Despite the challenges, HyperLiquid remains a leader in the perpetual futures market, representing over 50% of total trading volume.

HyperLiquid, one of the most prominent platforms in the perpetual futures market, finds itself in a delicate position after registering a record outflow of $60 million in USDC in a single day.

The fund outflows have sparked speculation about possible links to hackers from North Korea, who may be testing vulnerabilities on the platform. According to analysts, addresses associated with these actors incurred losses exceeding $700,000 while operating on the exchange, suggesting their activity might serve as a rehearsal for a more elaborate attack.

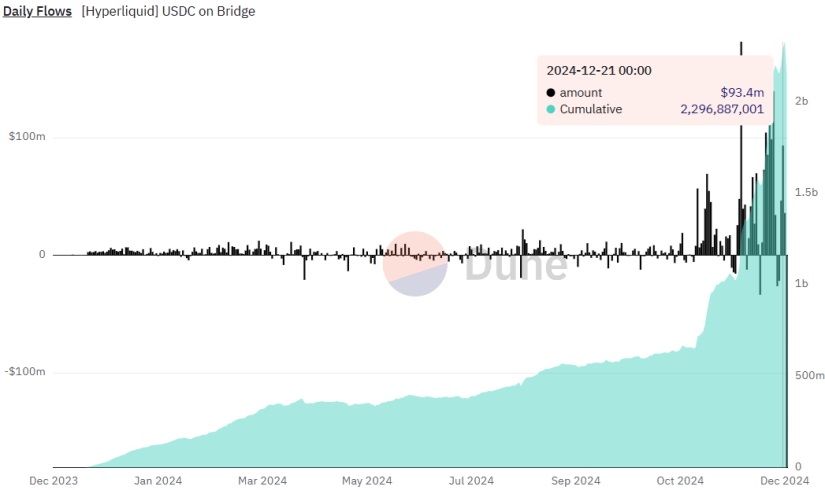

The platform, known as a decentralized exchange built on a layer-1 blockchain, is a cornerstone of the perpetual futures market. Currently, HyperLiquid accounts for over 50% of the total trading volume in this sector, with $8.6 billion traded in the last 24 hours. Despite the setbacks, the exchange’s deposit bridge still holds $2.2 billion in USDC, demonstrating a certain degree of stability in its reserves.

HyperLiquid Must Be Prepared for Any Scenario

An anonymous analyst identified as Tay, who monitors crypto market threats, noted that North Korean hackers typically use these platforms not to trade but to explore weaknesses in their infrastructure. Tay also offered their assistance to HyperLiquid two weeks ago to mitigate any potential risks, emphasizing the sophistication of threat groups associated with the Democratic People’s Republic of Korea (DPRK). These groups, Tay explained, evolve rapidly and have access to advanced tools, often unknown to others. An example of this is a recent vulnerability in Chrome that required an urgent patch.

Despite this complex scenario, HyperLiquid’s native token, HYPE, has shown explosive growth since its launch on November 29, 2024. In less than a month, HYPE has increased in value by more than 600%, reaching a price of $28.6 and positioning itself as the 22nd largest digital asset in the world, according to Coingecko data.

Having detected these suspicious interactions, it is crucial for HyperLiquid to work diligently to prevent any negative outcomes. The company has emphasized the importance of enhancing security in the crypto industry, particularly to counter state actors with access to sophisticated tools and tactics