TL;DR

- HYPE has stabilized at $29.5 after briefly dropping below $30, showing a moderate 1.5% recovery, though pressure at key levels remains.

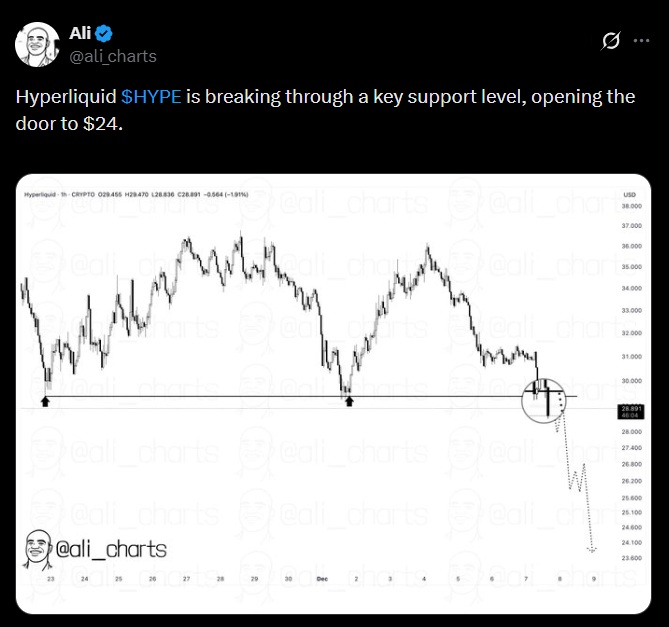

- The next support levels are at $26 and $24, and some technical projections even point to $16, reflecting the vulnerability of the downtrend that began in September.

- The market remains focused on supply absorption and the stability of critical levels.

Hyperliquid (HYPE) has stabilized near $29.5 following the recent dip below $30, but key levels remain under pressure. The token shows a moderate recovery, rising 1.5% over the past 24 hours, with price movements raising uncertainty among traders and analysts due to a combination of token unlocks and wallet activity.

What Do HYPE’s Technical Signals Show?

The drop below $30 marked the first clear breach of this support since November, and although the price has rebounded, technical signals indicate the market remains vulnerable. Analysts note that if HYPE fails to consolidate above $30–$32, it could test the next support levels at $26 and $24. Some technical projections even suggest a potential drop to $16 in the medium term, reflecting persistent pressure in the downtrend that began in September when the token traded above $55.

Wallet activity and upcoming token unlocks keep the market on edge. Recently, $2.2 million worth of HYPE was moved from team wallets ahead of the scheduled unlock of 10 million tokens. While mergers and buyback programs generate demand, traders warn that active supply still outweighs these absorption channels, increasing short-term volatility.

Market Watches Token Flow

From a technical perspective, HYPE remains near the lower Bollinger Band, with an RSI of 36 reflecting selling pressure but not extreme conditions. Volume has increased on the most recent red candles, showing heightened selling activity. Funding rates have cooled, indicating lower leverage use and cautious positioning among high-volume traders.

Separately, Hyperliquid Strategies began operations on December 3 under the ticker $PURR. The fund holds 12.6 million tokens along with $300 million in cash reserves, acting as a regulated treasury vehicle that provides exposure to the token. This structure could add stability to the ecosystem as released tokens are absorbed and support levels consolidate.

The market is closely watching how short-term pressure factors are managed. The recovery to $29.5 shows resilience against the dip, but token flow keeps attention on critical levels. To prevent a deeper correction toward $24–$26, traders need the token to strengthen above $30 in the coming days