The Cryptocurrency exchange Huobi has come under scrutiny from influential crypto analyst Adam Cochran, who has raised concerns about the exchange’s financial soundness. Cochran’s investigation into Huobi exchange’s balance sheets has revealed a stark contrast between reported and actual Tether (USDT) holdings, hinting at potential insolvency issues.

Discrepancy in Huobi Exchange’s Reported and Actual Holdings

2/3

So even all the other liquid assets on the exchange in total, are less than 1/3rd of the reported amount of USDT obligations. pic.twitter.com/MSenKpKKCu

— Adam Cochran (adamscochran.eth) (@adamscochran) August 6, 2023

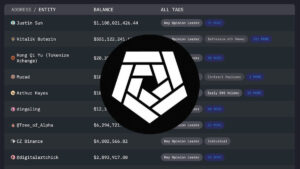

Adam Cochran’s analysis of Huobi’s “Merkle Tree Audit“ has unveiled a concerning gap in the exchange’s reported USDT assets. While Huobi exchange users believe they own $631 million worth of USDT, Cochran’s findings indicate that the actual holdings amount to a mere $90 million.

This significant disparity is raising red flags about Huobi’s ability to meet its financial obligations.

Cochran has gone on to suggest that Huobi’s founder, Justin Sun, might be mismanaging the exchange’s assets. He claims that Sun has been channeling funds from Huobi to his decentralized finance (DeFi) projects, inflating the yield on these projects to attract more deposits into the exchange.

According to him, “Tron’s own chain shows that 98% of the token is held by Sun or Huobi directly; and when you “stake” USDT into stUSDT it gets swept into a Huobi deposit address.”

Binance’s Involvement

Cochran’s analysis also points to actions by another major cryptocurrency exchange, Binance. He suggests that Binance’s aggressive sell-off of Tether (USDT) could be a strategic move aimed at weakening the position of the Huobi Exchange. Cochran implies that Binance might be reacting to suspicions about Sun’s overstated USDT holdings by taking measures to protect itself from potential repercussions.

1/16

So why is Tether selling off?

Likely Huobi insolvency.

-Binance started selling off USDT in bulk.

-We found out that Huobi execs (and Tron personnel questioned by police)

-This is not long after Sun's stUSDT launch

-And weird balance shifts at Huobi in the last month pic.twitter.com/f3HViYS93a— Adam Cochran (adamscochran.eth) (@adamscochran) August 5, 2023

The claims of the analyst are further fueled by reports of Chinese authorities investigating key individuals within Huobi and Tron, including high-ranking exchange representatives. These reports add credibility to the concerns about Huobi’s financial stability and contribute to the growing apprehension within the cryptocurrency community.

Despite Cochran’s analysis and allegations, Huobi has denied any wrongdoing and maintains that its operations are proceeding normally. However, if these concerns persist and users start losing confidence in the exchange’s financial stability, it could trigger a mass withdrawal of funds from the platform.

It’s worth mentioning that such a scenario could potentially lead to market turbulence and impact the broader cryptocurrency landscape, just as it happened in November last year with the currently insolvent FTX cryptocurrency exchange.