TL;DR

- HumidiFi, Solana’s leading DEX, will launch its $WET token through Jupiter’s new Decentralized Token Formation (DTF) platform.

- $JUP stakers will get early access to the $WET presale, while venture capital funds will be excluded.

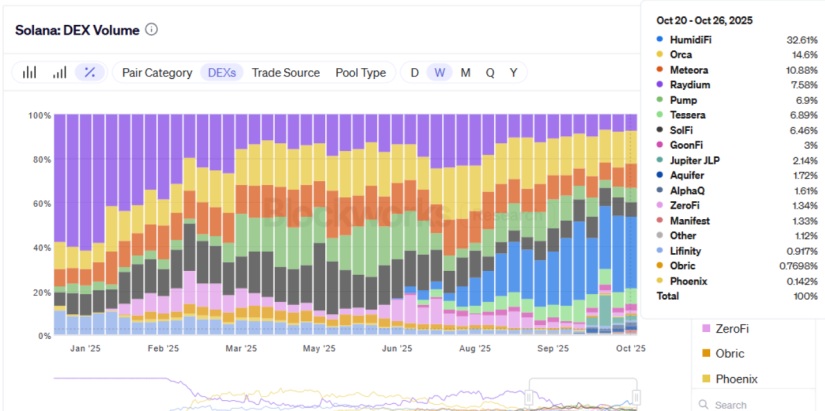

- Launched five months ago, HumidiFi handles over 30% of Solana’s weekly swap volume and has surpassed Raydium and Orca thanks to its proprietary AMM model.

HumidiFi, the dominant decentralized exchange on Solana, will launch its $WET token through Jupiter’s newly introduced Decentralized Token Formation (DTF) platform.

The announcement was made during Planetary Call #59, where Jupiter’s COO, Kash Dhanda, confirmed that $WET will be the first token to debut on DTF, marking the start of a new public launch model within the Solana ecosystem. The program aims to revive the spirit of the early ICOs while introducing safeguards to reduce risk and ensure greater transparency and user protection.

According to Dhanda, users staking $JUP will gain early access to the $WET presale at preferential prices, designed to encourage deeper engagement across Jupiter’s ecosystem. The company officially announced its partnership with HumidiFi in a statement released Wednesday, noting that DTF is built to “bring out the best of ICOs while protecting users from their worst excesses.” The launch also represents a milestone for HumidiFi, making it the first proprietary AMM to issue a token through Jupiter.

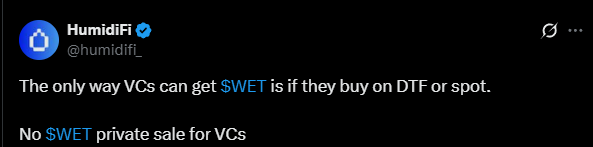

HumidiFi stated that there will be no private presales of $WET for venture capital funds. Institutional investors will only be able to purchase the token through DTF or directly on the spot market. With this decision, the team seeks to guarantee fair access and prevent concentration of ownership, favoring an open, community-driven distribution.

HumidiFi: Solana’s Most Active DEX

Launched just five months ago, HumidiFi has quickly become the most active DEX on Solana, processing roughly one-third of the network’s total swap volume. Data from Blockworks shows that the protocol captures over 30% of weekly volume and has surpassed legacy platforms such as Raydium and Orca. Its rapid growth stems from the use of a proprietary AMM model—also referred to as a “Dark Pool”—that eliminates public liquidity pools and relies on an algorithmic market-making system to minimize slippage and enhance price efficiency.

HumidiFi’s design has attracted traffic from major Solana aggregators, including Jupiter, which routes a significant portion of its swaps through the protocol. Although its mechanics are less transparent than those of traditional AMMs, ecosystem auditors and analysts have verified its security